Berlin is imposing a five-year rent freeze—Could it work in New York City?

Photo via Pixabay

In June, New York State rolled out a slate of proposals to protect renters. Among other changes, the new legislation closes several loopholes that have permitted owners to legally spike rents following renovations—a tactic that has been successfully used to deregulate more than 150,000 units over the past two decades. In essence, under the new legislation, owners will no longer be able to deregulate rent-regulated apartments at all. While the new legislation is certainly good news for many renters, for the tens of thousands of New Yorkers who now already live in unregulated apartments, the current legislation doesn’t fix their current woes. But could a five-year rent freeze help? It may sound impossible, but this is precisely what Berlin—once an oasis of inexpensive rents—has just approved as a way to put the brakes on rising rental prices.

Berlin’s changing rental landscape and five-year price freeze

Just a decade ago, Berlin was still known around the world as a phenomenally cool city where one could rent a large apartment at a very reasonable rate. As Berlin’s economy has improved and its tourism industry has expanded, finding an affordable apartment in some of Berlin’s most desirable neighborhoods has become increasingly difficult.

By one estimate, since 2008, Berlin rents have doubled from 5.60 euros to 11.40 euros. Downtown neighborhoods such as Friedrichshain-Kreuzberg have been especially hard hit. And prices aren’t just soaring on the rental side of the market. Buying a unit in Berlin is also increasingly out of reach. According to a recent report by the UK-based Frank-Knight, in 2017, Berlin bucked global trends, becoming the only major city in the world to report real estate price growth above 20 percent. However, in a city with more renters than any other European city, Berliners’ real concern remains the rising cost of rentals.

To be clear, Berliners are still not as hard up as people in New York, London, Paris, or Tokyo, but there are fears the city may be heading in this direction. On average, one-bedroom units in Berlin’s center are about 1,000 euros per month. Of course, this figure reflects area averages, and therefore, takes into account the high number of units still being rented out at pre-gentrification prices. As a result, if you’re new to Berlin’s housing market and looking for an apartment, you’ll likely pay much more than 1,000 euros monthly for a decent one-bedroom unit in a desirable neighborhood—as much as 1,500 to 2,000 euros or roughly $1,700 to $2,250 USD.

With rents rising, competition is also getting tough. A recent BBC report noted that over 100 prospective tenants often show up for apartment viewings. To stand out, some Berliners have reportedly even started to bribe prospective landlords who are willing to take them on as tenants. One couple, both professional photographers, reportedly offered prospective landlords a free photoshoot. Another house hunter posted a sign offering regular baking to any landlord willing to rent her a flat. While a free photoshoot or weekly fresh-based bread may not be enough to close a deal in New York City, such bribes are apparently growing increasingly common in Berlin’s rental market.

To put the kibosh on the rising rents, tough competition, and bribes, on June 18, the Berlin Senate voted in favor of a five-year rental freeze. Although planned to take effect on January 2020, the freeze will be applied retroactively from June 18. While many Berliners are in support, not everyone in Germany is happy about the proposal. Some critics worry that the freeze will prevent landlords from making necessary repairs to their buildings. Business analysts also fear the freeze may negatively impact Berlin’s economy. Even Chancellor Angela Merkel is skeptical. She’s suggested that building more affordable housing in the city may be a better solution.

Could a five-year rental freeze work in New York City?

Theoretically, a five-year freeze on both rent-regulated and market-rate units could be imposed—albeit not without major backlash from the real estate industry—but would it help control the city’s already inflated rental market?

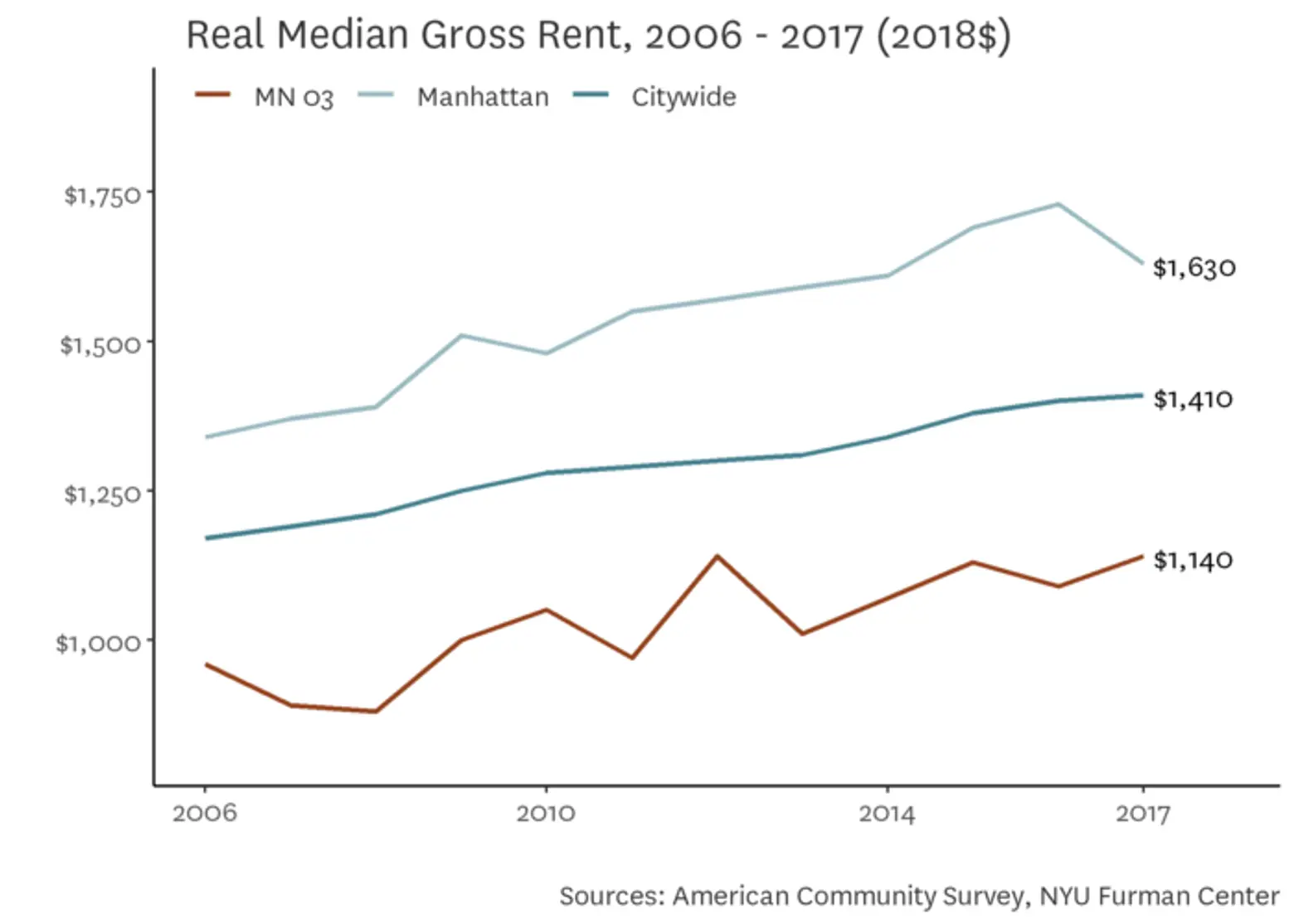

NYU Furman Center’s historical data reveals that a lot can happen in five years, depending on a wide range of factors. The graph above features real median gross rental prices for MN 03 (the Lower East Side-Chinatown) compared to Manhattan and citywide rents from 2006 to 2017. As illustrated, had a five-year freeze on rents come into play in 2012, average rental prices would have been about $200 less on average by 2017. However, in the inflated Lower East Side-Chinatown market, a rental freeze in 2012 would have had virtually no impact on real median gross rental prices at all since the freeze would have happened during the area’s 2012 peak in prices.

Another risk of imposing a five-year rental freeze in New York City is what would happen next. In Berlin, no new lease can be 10 percent higher than the previous lease, but in New York, owners of unregulated units are free to raise rents as high as they like when an apartment turns over and even when an existing tenant renews a lease. The risk, then, is that if the city did impose a five-year freeze, owners would rebel and spike rents after the freeze, creating an even more untenable rental landscape.

RELATED: