October 20, 2014

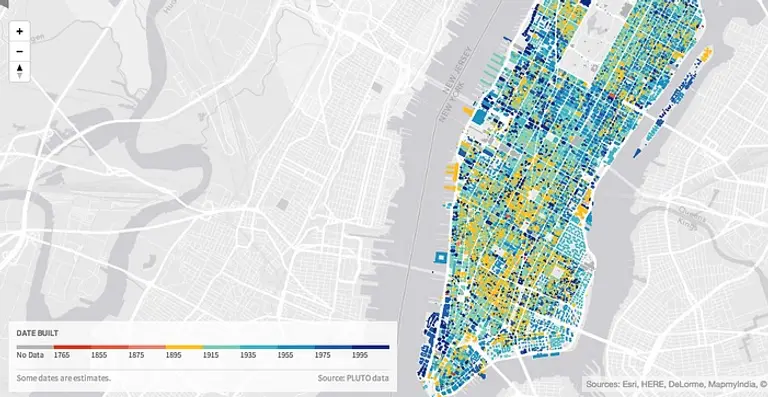

Following Superstorm Sandy, FEMA (Federal Emergency Management Agency) updated its flood-zone maps for the first time since 1983, more than doubling the included buildings to 70,000. Therefore, many more property owners are facing the decision of whether to stormproof their homes or pay up for insurance premiums that would go up as much as 18%. But going with the former choice is not as easy as one may think.

FEMA guidelines don't take into account the unique makeup of New York City with its rowhouses and high-rises, so to comply with the current regulations it would cost the city more than $5 billion, according to studies produces by Crain's. Those who would be absorbing the costs include middle-class homeowners; NYCHA, which owns more than 25% of rental units in the flood zone ;and owners of large apartment towers, which account for 61% of the 5.5 million properties in FEMA's National Flood Insurance Program. All of these entities must follow the same guidelines as the plan is laid out now, but the city and a group of nonprofits are asking the agency to make changes to the insurance program.

More about the issue ahead