January 21, 2015

Most landowners, especially those who have been in the development business for a long time, aren't easily persuaded to sell their holdings, but with sales reaching record sums, that's all starting to change.

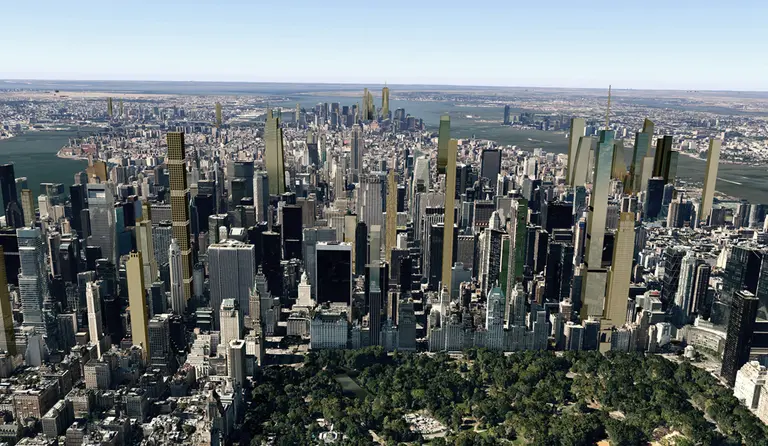

As Crain's recounts, back in November Jerry Gottesman, who has a property empire worth over $3 billion, sold a parking lot he owned between 17th and 18th Streets near the High Line for $800 million. He bought the site in the early '80s for $2.4 million. Influenced by the sale, other landowners are also looking to get in on the action; just last week three large residential development sites hit the market asking $1,000 or more per buildable square foot–a 50 percent increase in the price of Manhattan land from last year. And if the parcels fetch these sums, it will be the first time values per buildable square foot reach four figures. With these record sale sums, Manhattan condo builders would have to sell units at sky-high prices to make a profit. For example, a 1,000-square-foot apartment would need to sell for $3 million or more just to break even.

More on the trend here