421-a tax break will continue to cost NYC revenue for decades after it expires, report finds

Photo by Patrick Tomasso on Unsplash

The 421-a tax abatement program, which gives real estate developers who construct new residential buildings a property tax exemption in exchange for designating a portion of the homes affordable, will expire on June 15 after state lawmakers last week did not renew it during the final day of this year’s legislative session. Even with it set to lapse, the controversial program will continue to cost the city revenue for decades, according to a new report. According to findings published Monday by the Independent Budget Office of New York City, the tax abatement program will cost the city over $1 billion annually until 2034, with total costs not ceasing until the fiscal year 2056.

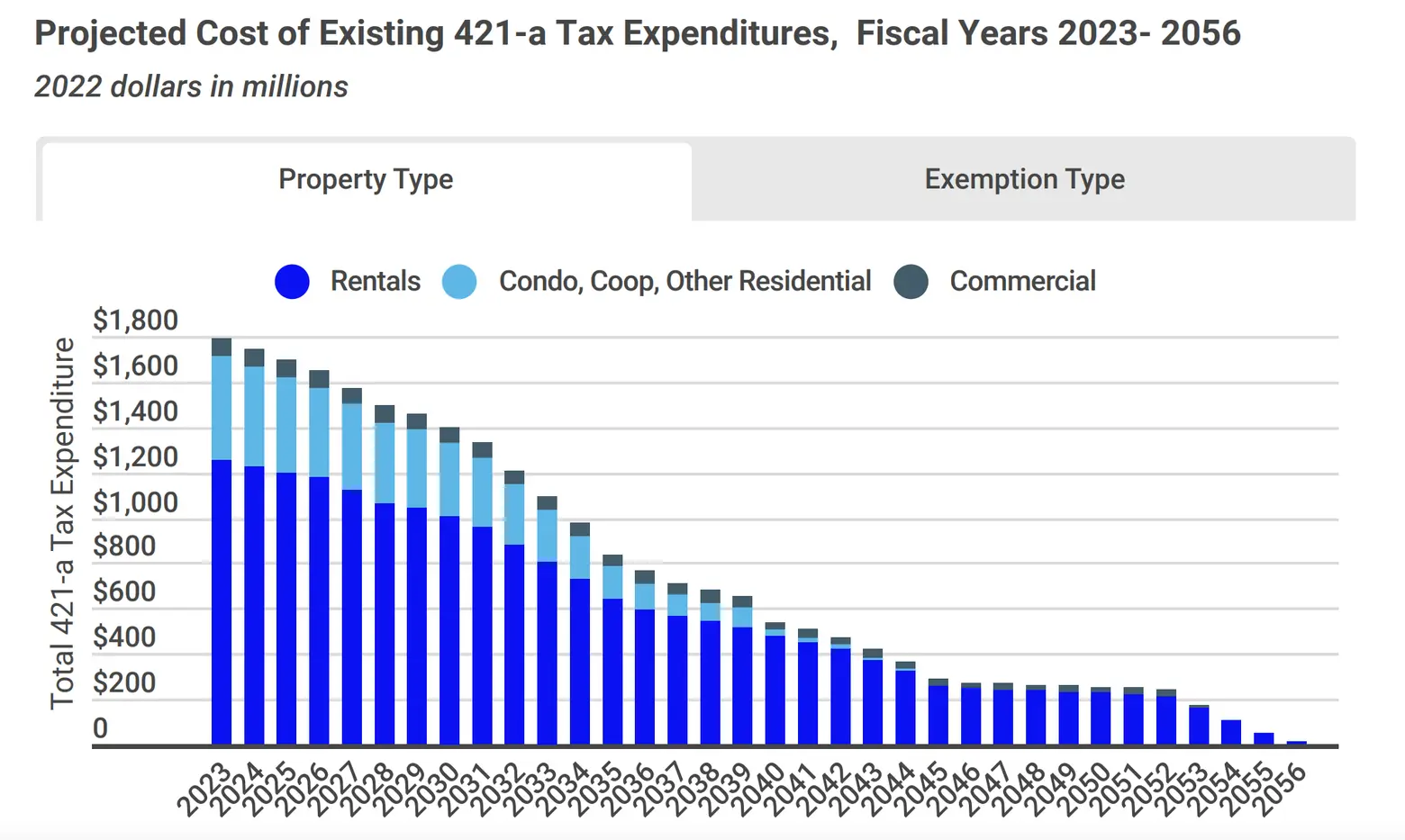

Chart courtesy of the New York City Independent Budget Office

First created in 1971, the 421-a tax abatement program provides a property tax break for developers who designate a portion of their new properties as affordable housing. According to the New York Times, the program was first implemented to promote new construction at a time when the city was struggling financially and development had slowed.

When estimating the future expense with no new exemptions granted after June 15, the IBO found existing exemptions will cost the city over $1 billion a year from the fiscal year 2023 through 2033, with the yearly cost falling below $1 billion in 2034 and decreasing to $6.8 million by 2056. Of all of the city’s properties utilizing the tax abatement, buildings in Brooklyn and Manhattan make up 83.5 percent of the cost.

While Gov. Kathy Hochul released a replacement plan for 421-a in January, lawmakers rejected the governor’s proposal because it did not change the structure of the abatement enough.

In March, the city’s Comptroller Brad Lander called for an end to 421-a because it cost the city an estimated $1.77 billion in lost revenue for 64,000 tax exemptions during the fiscal year 2022. The comptroller’s office found the income-restricted units that stem from 421-a buildings are not affordable to most residents, with more than 60 percent of the non-regulated units created between 2017 and 2020 set aside for families earning 130 percent of the area median income, or $139,620 for a family of three.

Lander said there’s now an opportunity for major property tax reform.

“There’s some good news. The largest “affordable” housing expenditure is 421a, which is on track to expire,” Lander tweeted last week. “Now, we need to rally together to make sure now is the time for comprehensive property tax reform.”

RELATED: