Huge Tax Disparities Along Central Park Become Visuals in Architectural Art Installation

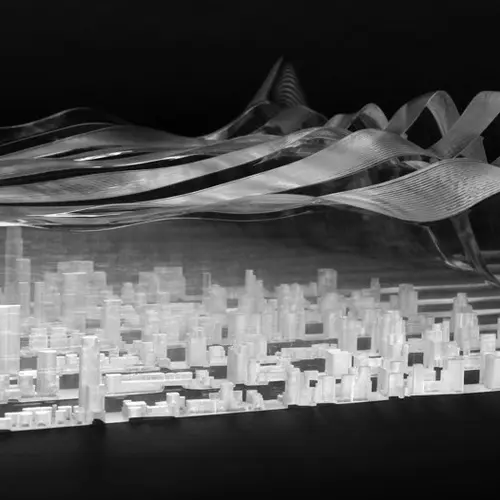

“Section 581” by SITU Studio, Photograph by Patrick Mandeville

“Section 581” by SITU Studio, Photograph by Patrick Mandeville

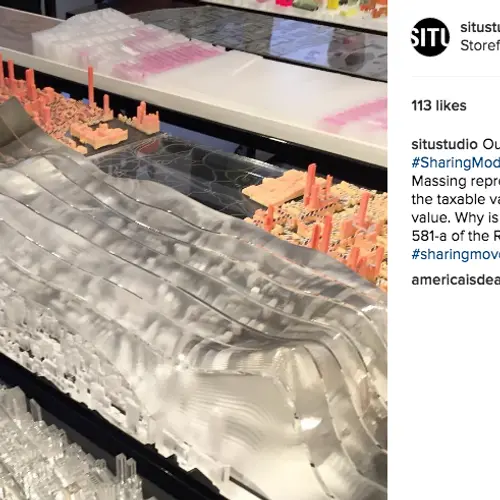

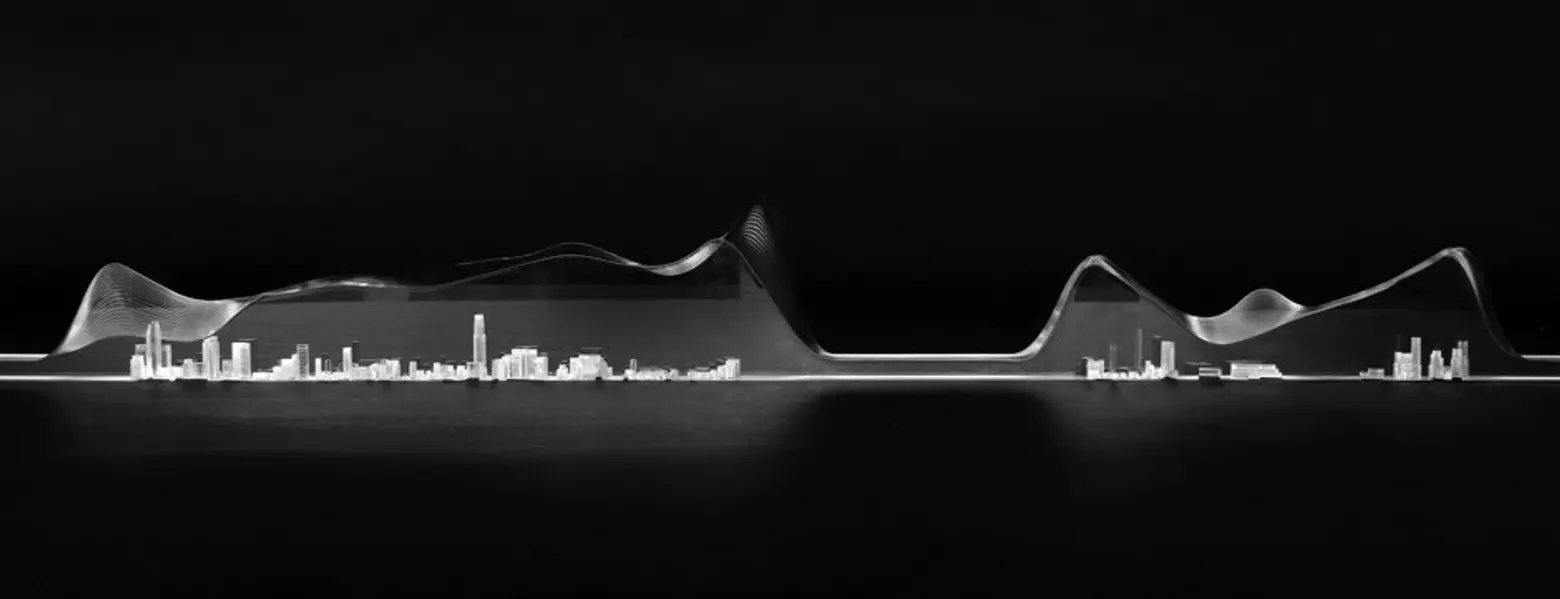

Billionaires get off nearly tax-free and billions go uncollected due to flaws in the way the city assesses property value. As part of a new exhibit at the Storefront for Art and Architecture in Soho, interdisciplinary architecture firm SITU Studio created visual representations of these inequities in one of their most glaring examples: the buildings along Central Park.

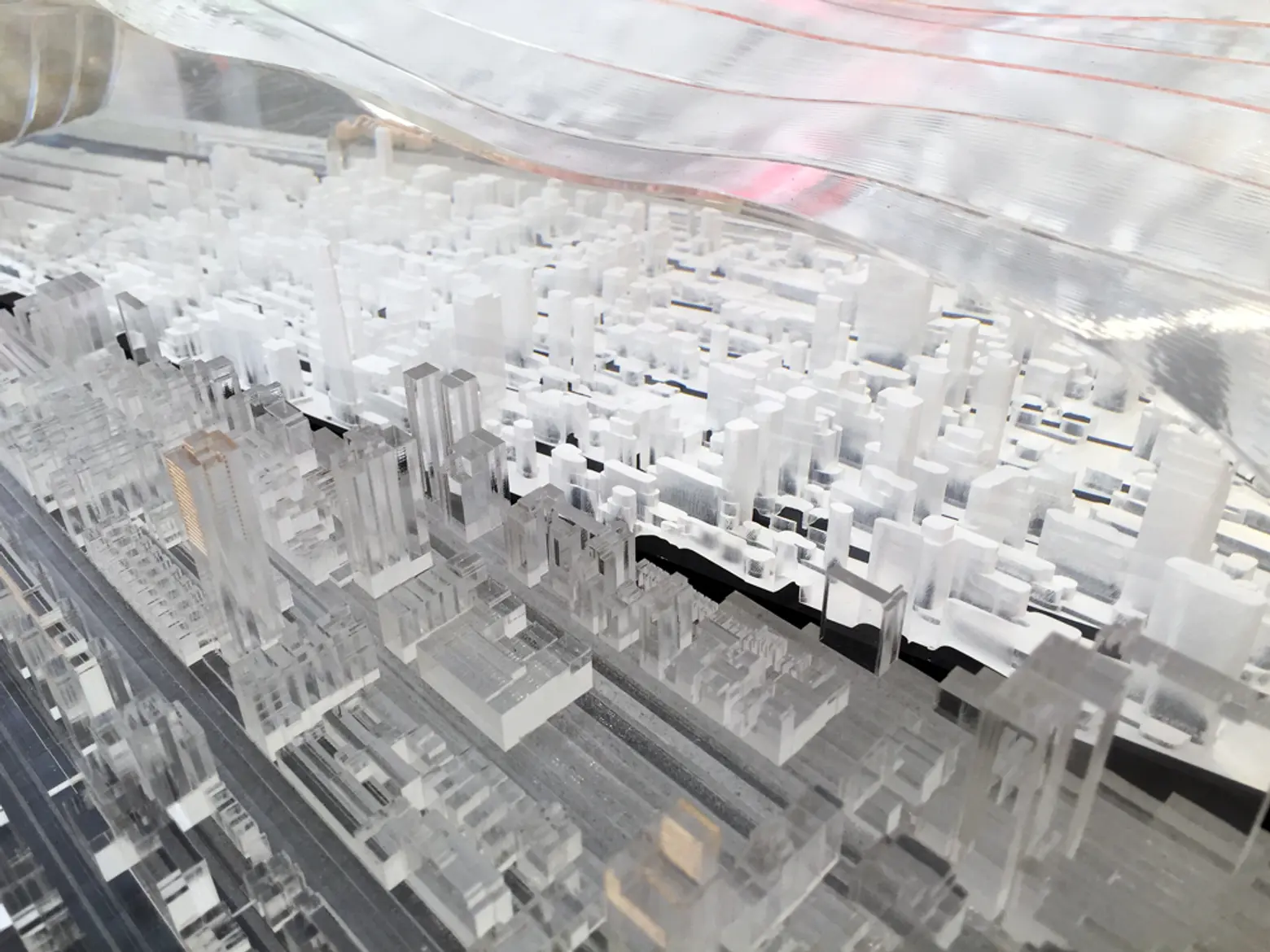

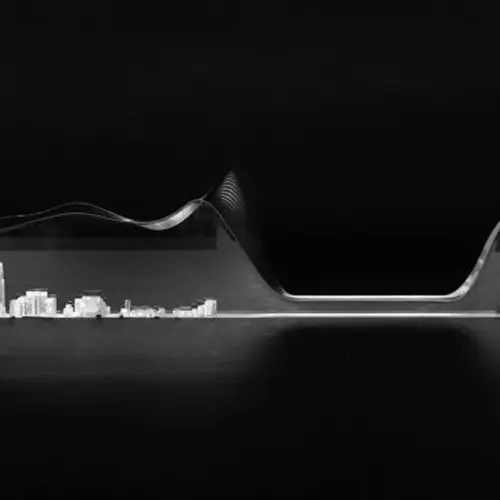

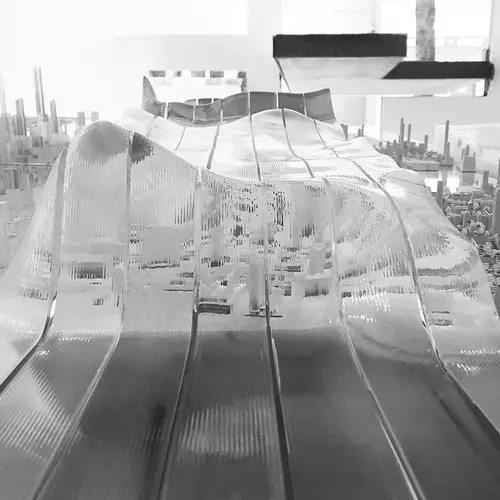

New York City’s property tax structure assigns higher real property taxes to renters than it does to the infamous absentee owners of the trophy condos on Billionaires’ Row, short-changing the city of millions in annual revenue, according to CityLab. The acrylic bands in the SITU models show the disparity between the taxed value of these properties and the sky-high amounts they’d actually sell for.

Acrylic bands in models created by SITU Studio show the disparity between the assessed tax value and sales value of the city’s most expensive properties. Photograph by Patrick Mandeville

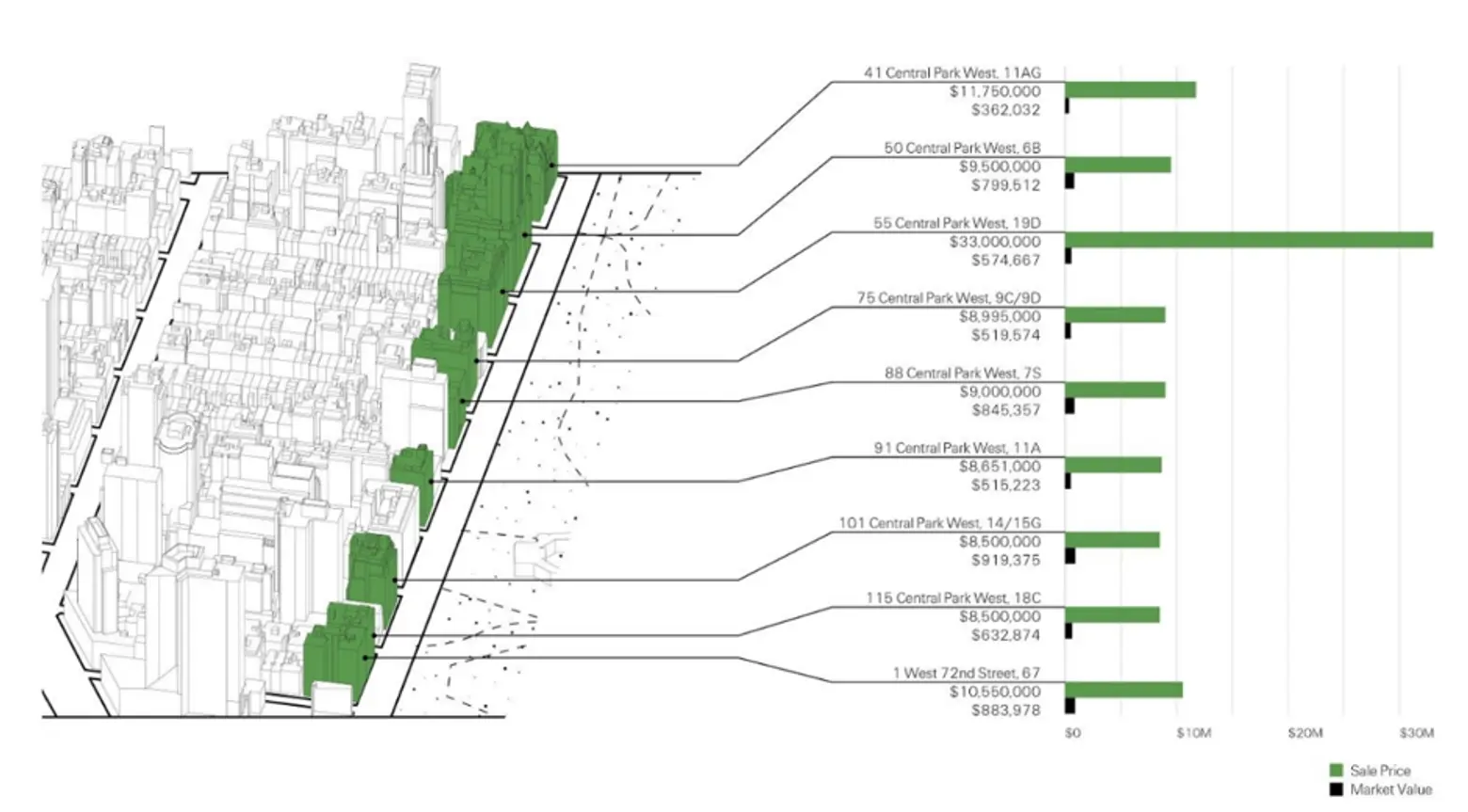

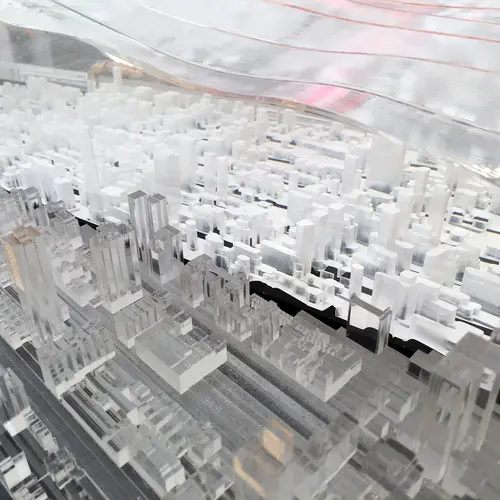

The state-mandated formula used by New York City to calculate property taxes for condos and co-ops is not only complicated, but it wildly underestimates the value of of some of the city’s astronomically valuable properties, which means their billionaire owners–such as a $33,000,000 co-op sale on Central Park West where the city assessed the market value of the entire building at $60,722,00 for 2017, making the co-op’s sale price almost 60 times its assessed value for taxation purposes–end up paying a fraction of the taxes paid by other not-so-billionaire New Yorkers. And property tax is the city’s biggest source of revenue.

This worrisome wrinkle is the subject of one of the entries in “Sharing Models: Manhattanisms,” a show that opened Friday at the Storefront for Art and Architecture. The show, which runs through Friday, September 2, gives 30 international architectural firms (including big names like Archi-Techtonics and ODA) the task of analyzing a slice of Manhattan.

SITU Studio serves up a hefty portion by spotlighting the inequity baked into the city’s property-tax distribution. Highlighting sections of the Upper East Side and Upper West Side, the firm’s project is titled “Section 581,” for the state code that outlines the way property taxes are assessed. To show how big the gap between property value and taxed value is, the firm uses acrylic ribbons flying atop the city’s trophy towers.

According to an essay that accompanies the project, “The most valuable rental buildings in Manhattan are valued by the Department of Taxation and Finance at well under $500 per square foot. The market has seen luxury condo sales typically made at a much higher expense per square foot—often in the $4,500 range.”

In SITU’s visualizations, the highest disparities can be seen in the narrow band along Central Park West and Park Avenue, leading to an estimation that the undervaluation of the properties in this sliver of Manhattan alone adds up to a mind-boggling $5.2 billion.

“Section 581” by SITU Studio, Photograph by Patrick Mandeville

The project uses research by New York University’s Furman Center for Real Estate, a 2015 report by CityLab, and Max Galka’s visualizations of property-tax undervaluation shown in charts at Metrocosm. But the three-dimensional aspect gives data visualization a dramatically tactile aspect when it comes to property tax undervaluation–and how New York state law makes New York City give an unfair advantage and a huge slice of tax revenue to billionaire condo owners.

[Via Citylab]

RELATED: