New Maps Show How Much You Need to Work in Order to Own a Home in NYC and Other Major Metros

Image via CityLab

Have you been thinking about buying a home in NYC? Well if you’re single, get ready for a life of mortgage-gouging hardship. A new study conducted by the Martin Prosperity Institute takes a look at how much Americans spend on housing, where in the United States we’re spending the most, and how many years we’ll need to put in if we want to own a home in a big city.

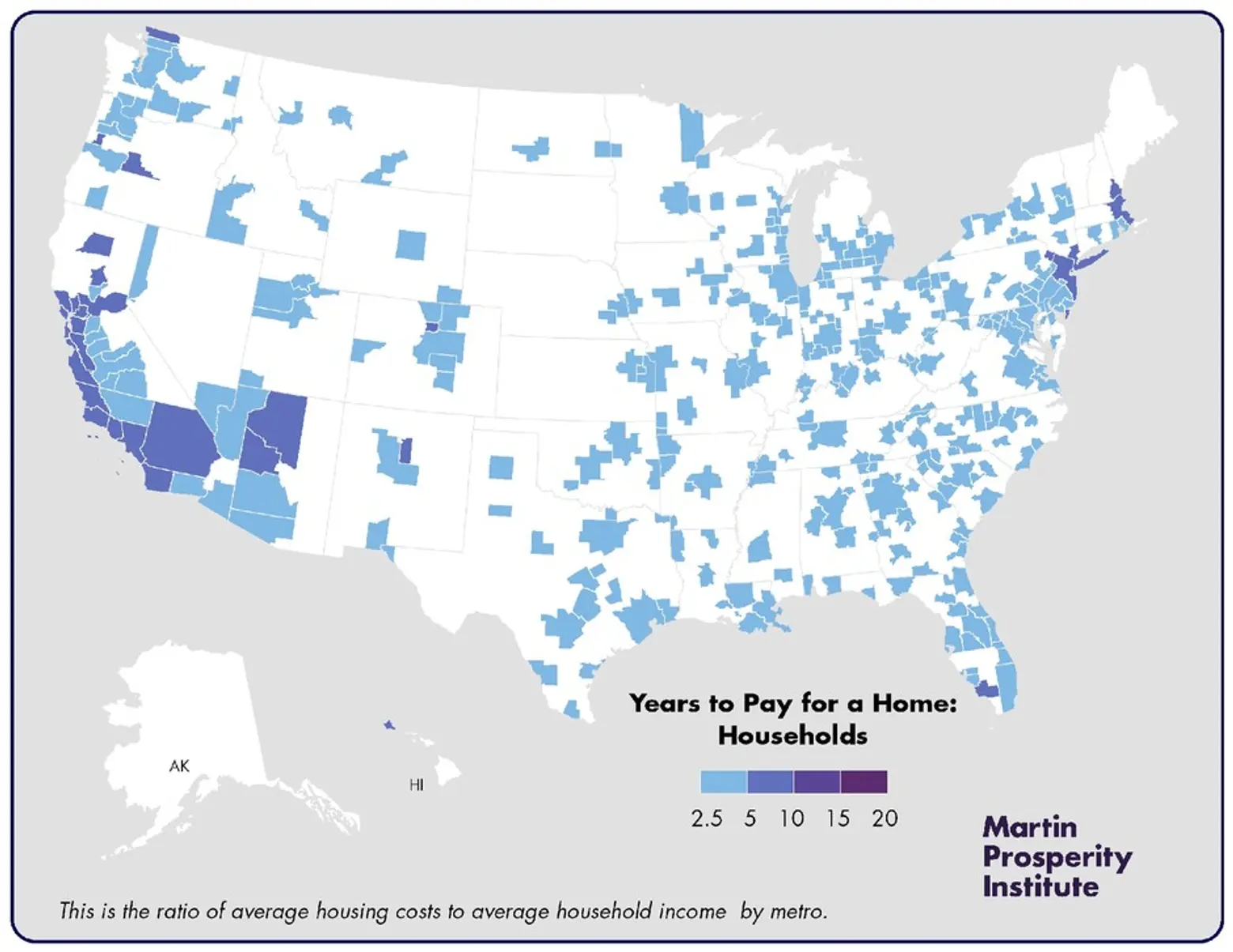

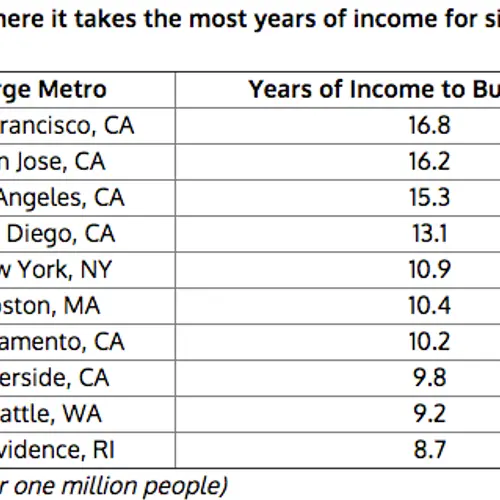

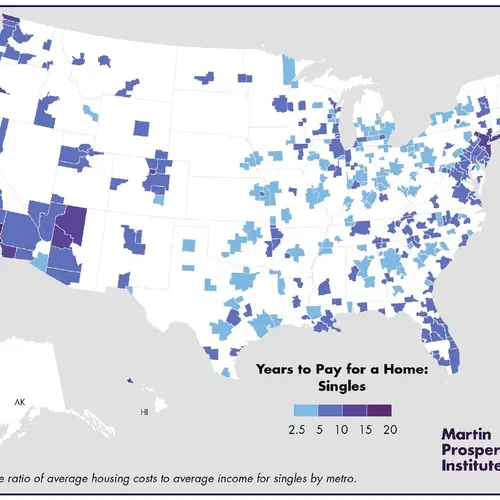

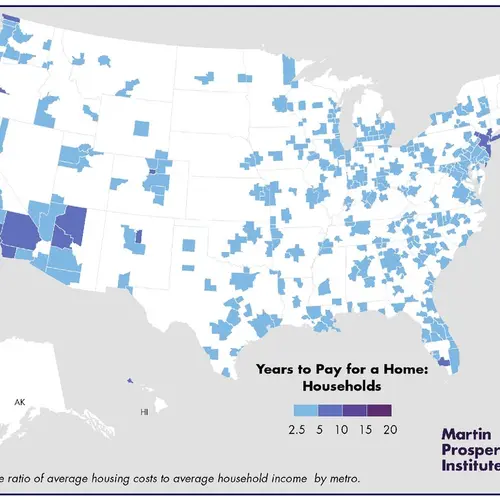

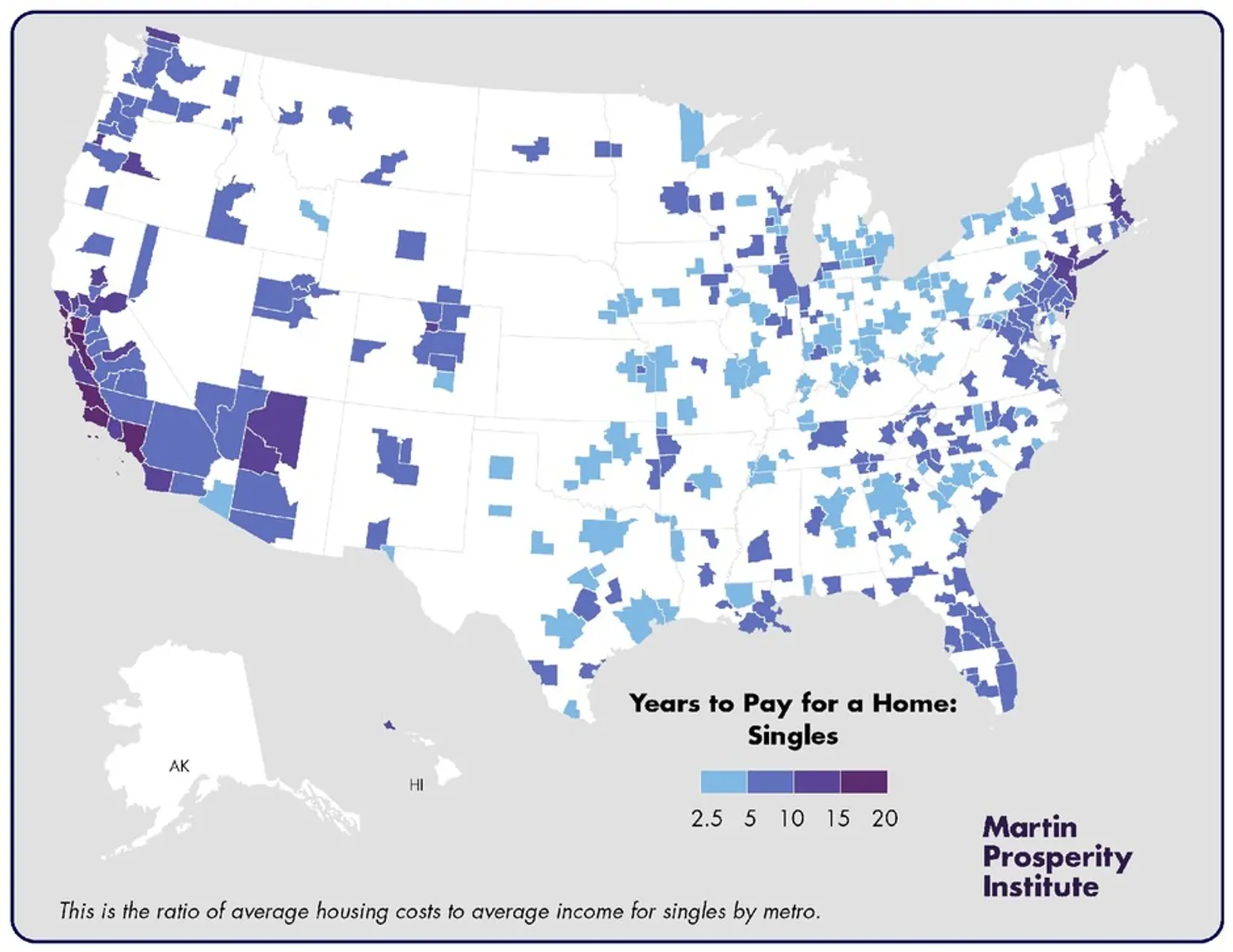

The study, led by Richard Florida and Charlotta Mellander, comes with two maps that show the average amount of money it takes for both individuals and households to pay for a home in a U.S. metro area. “We calculated the number of years’ worth of income, on average, it would take to buy a home in metros across the country,” Florida writes. “To do this, we compared data on the average estimate sale prices of homes in metro areas from Zillow to data on average incomes in those same metro areas for both families and singles from the U.S. Census.”

The calculation however does not account for mortgage interest, which the authors note could drive the cost far higher. They also ask that you to take in to consideration that the rule of thumb in home buying is that you should by a house roughly 2.6 times your annual income.

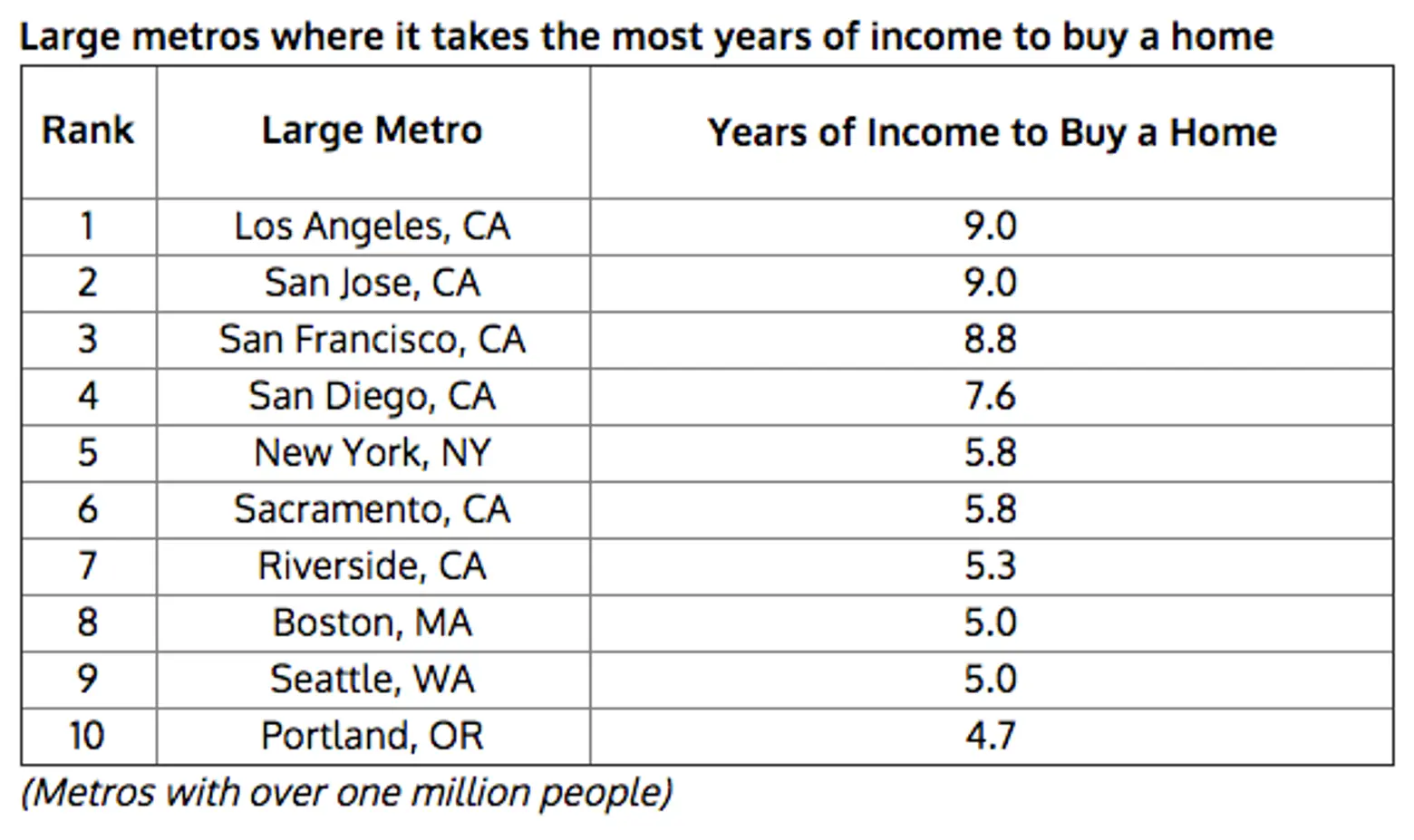

The maps show that those areas shaded in light blue are metros with households that pay the least for housing, while those in the dark purple areas pay the most. Unsurprisingly, cities in coastal California (from Los Angeles up to the Bay Area), New England and New York are amongst the most expensive. However, to our surprise, New York City ranked fifth, falling below four Southern California cities. NYC households on average are pouring 5.8 years of their income to purchase a home whereas Angelenos pay up to 9 years.

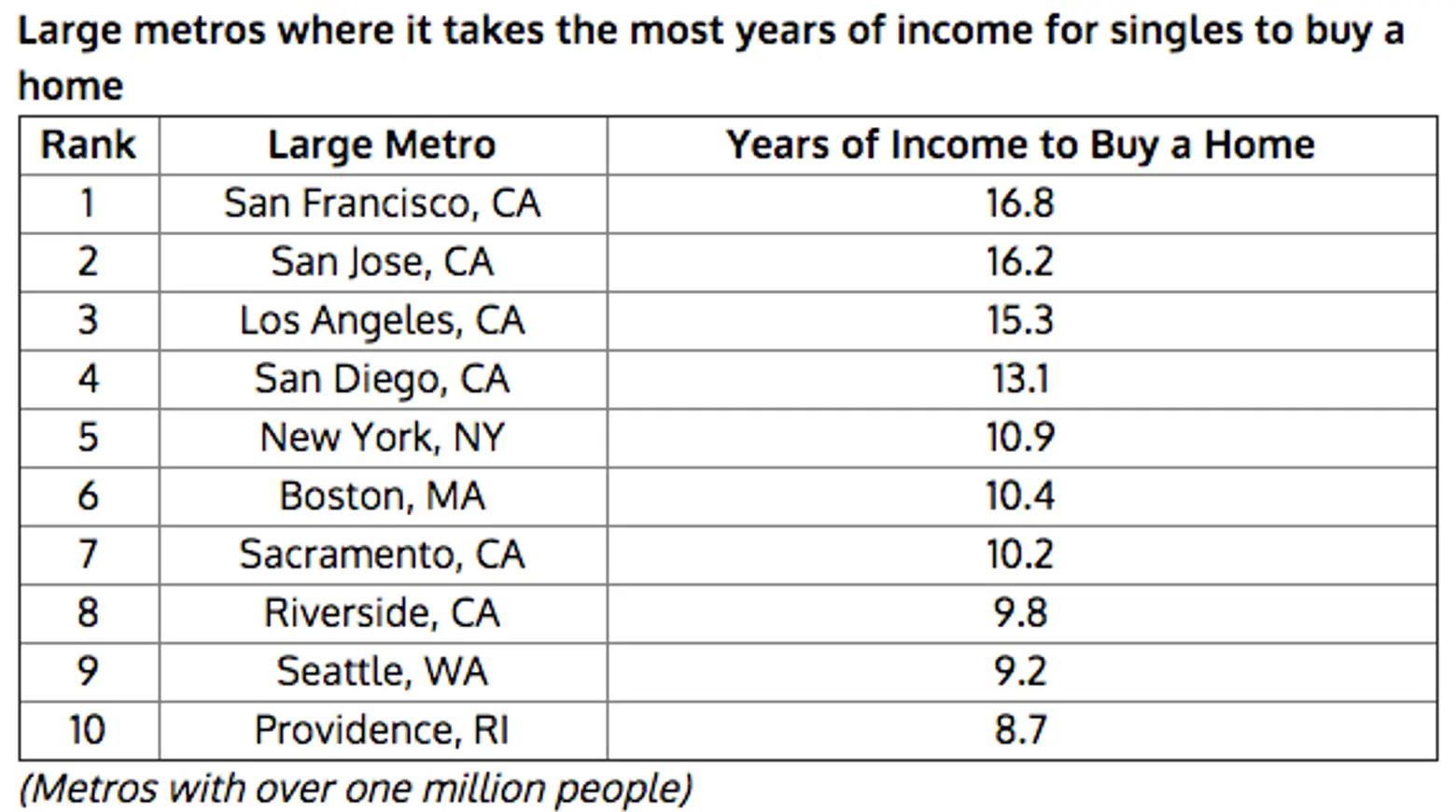

When the study zoomed in on single folks in the home buying market, the picture became far more bleak for those not shacked up. The same geographic patterns emerge but the stretch of time more than doubles for some areas. For singles in New York, it will take an average of 10.9 years of income to purchase a home. However, compared to San Francisco’s 16.8 years, the number isn’t so gut-wrenching.

If you want to see how other U.S. cities faired, and where you should move if you don’t feel like dedicating the best years of your life to paying off a home, head over to CityLab.

[Via CityLab]

RELATED: