Billionaires’ Row property taxes would dramatically increase under proposed system overhaul

Image courtesy of Vornado Realty Trust and Robert A.M. Stern Architects

Last month, the city’s Advisory Commission on Property Tax Reform revealed a report outlining sweeping changes to the property tax code that would essentially raise the same amount of money but substantially redistribute where it comes from. Under the current system, property owners pay taxes based on assessed value rather than market value, so working-class homeowners often pay a higher tax rate than those who can afford the city’s multimillion-dollar luxury condos. Mansion Global took a closer look at the numbers and found that property taxes along Billionaires’ Row could increase up to five times their current rate under the proposed system.

Although the report does not propose any specific tax rates, it looks at Ken Griffin’s record-breaking $238 million sale at 220 Central Park South as a hypothetical example. Griffin’s four-story condo is currently taxed at its estimated market value of $9,370,212 and Griffin’s annual tax bill comes out to $531,797—an effective tax rate of only 0.22%. If his taxes were assessed based on the home’s transaction price, his bill would increase to $2,987,233, or more than five times the current amount.

Mansion Global used the formula outlined in the city’s report to calculate how neighboring properties would be impacted. Sting—who recently bought a penthouse at 220 Central Park South for $65.75 million—would likely see his tax bill increase 489% from about $140,000 to $825,000 while Jeff Bezos would see his taxes double and exceed $1 million for his spread at 212 Fifth Avenue.

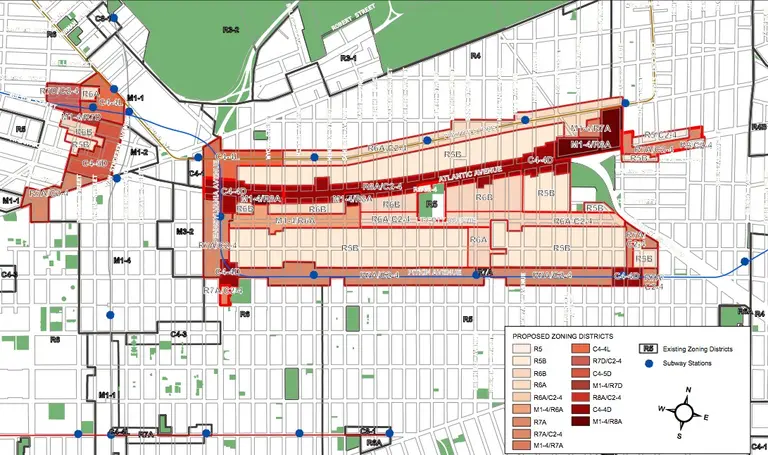

The proposed system would also impact middle and upper-class New Yorkers who own property in some of the city’s most gentrified neighborhoods, like Prospect Park, Cobble Hill, and the Upper West Side. A New York Times article outlining the winners and losers of the new system gave the example of Prospect Park resident Mark Chalfin, who bought a brownstone for $125,000 in 1980 and still has his taxes capped at $12,000 a year even though his home is now valued at $4.63 million.

“There are many, many New Yorkers whose net worth is tied up mostly in their real estate, and if their property were assessed at market value, it would be like serving them an eviction notice,” Donna Olshan of Olshan Realty told Mansion Global.

Any changes to the system are still years away. The commission will hold additional public hearings in each borough over the coming months, which will inform its final report. The final proposal will require support from both city and state legislatures and is likely to be phased in over a five-year period, as the current proposal recommends.

[Via Mansion Global]

RELATED: