New study finds reasons for storefront vacancy are as varied as NYC neighborhoods themselves

Image: Steven Pisano via Flickr.

Amid discussions of gentrification and astronomical rents, it’s impossible not to notice the alarming appearance of vacant storefronts in what seems like every neighborhood in New York City. A new report from the Department of City Planning (DCP) has attempted to get a closer look at the data behind this phenomenon to get a better understanding of how the city’s retail and storefront uses may be changing. The report, titled “Assessing Storefront Vacancy in NYC,” looks at 24 neighborhoods as case studies. The very detailed study found that, overall, storefront vacancy may not be a one-answer citywide problem. Vacancies were found to be concentrated in certain neighborhoods, and the reasons appear to be as many and varied as the neighborhoods themselves.

Photo via Dan Nguyen/Flickr

Some of the reasons for storefront vacancies were more obvious than others. The study found a wide range of conditions and multiple factors that influence the retail mix and vacancy conditions in complex ways. These include the rise of e-commerce, demographic shifts, real estate market trends, local building stock and other conditions that may vary from street to street and certainly from neighborhood to neighborhood.

In addition to the more obvious changing retail environment, contributing factors included shifting consumer habits, taxes, rents, and complex business and land use regulations. The study found, however, that there was no single dominant retail trend in retail in New York City, but that all of them all have different effects in shopping districts throughout the city.

The top-level findings in the study:

- The retail industry is changing rapidly across New York City and the country.

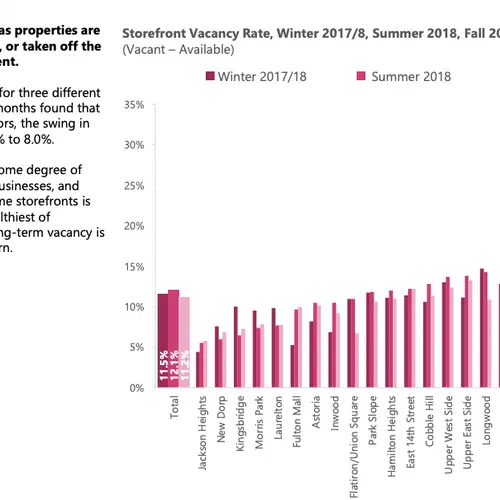

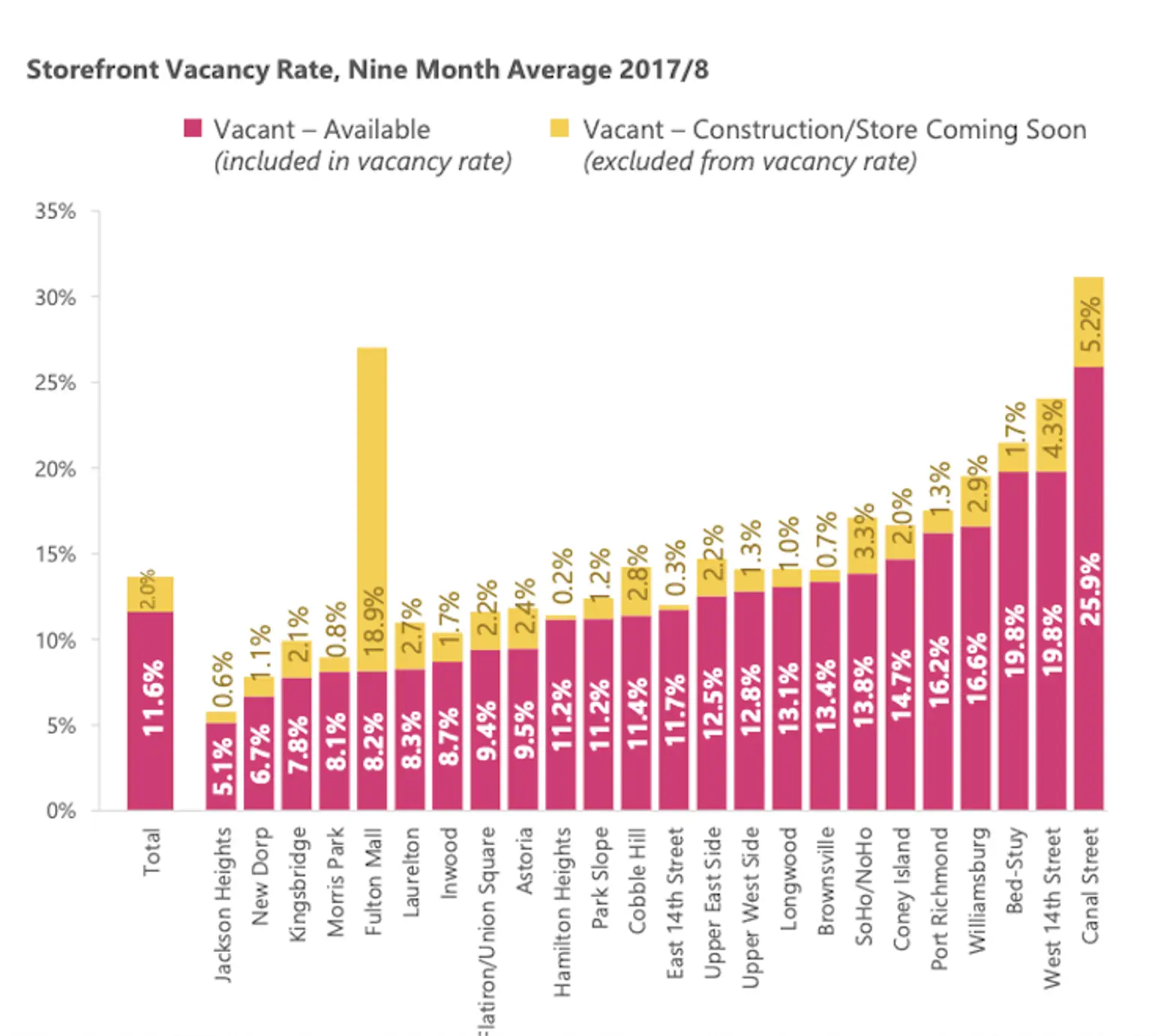

- Vacancy rates are volatile, vary from neighborhood to neighborhood and street to street, and cannot be explained by any single factor.

- Vacancy is concentrated only in certain neighborhoods and is influenced by local and citywide market forces and spending patterns.

The first major takeaway from the study may be the most obvious one: The entire retail industry has seen a rapid shift in New York City and the country as a whole. E-commerce spending is growing rapidly–but brick-and-mortar retail spending is growing, too. Storefront uses are evolving; food and beverage and services lead the city’s storefronts in employment growth. Within the neighborhoods the study looked at in 2008-09, the share of dry retail in storefronts has declined. And while dry retail’s footprint may be getting smaller, the presence of experiential businesses like gyms, spas, and salons is growing.

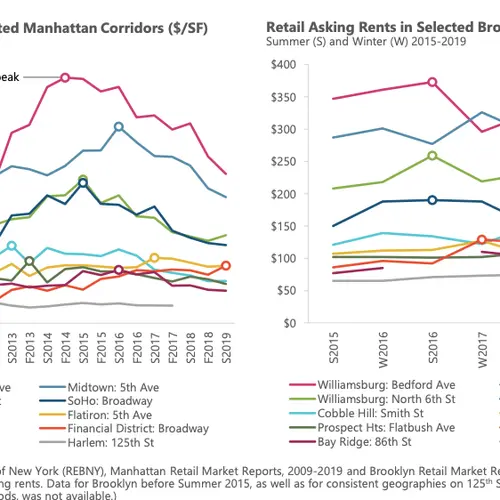

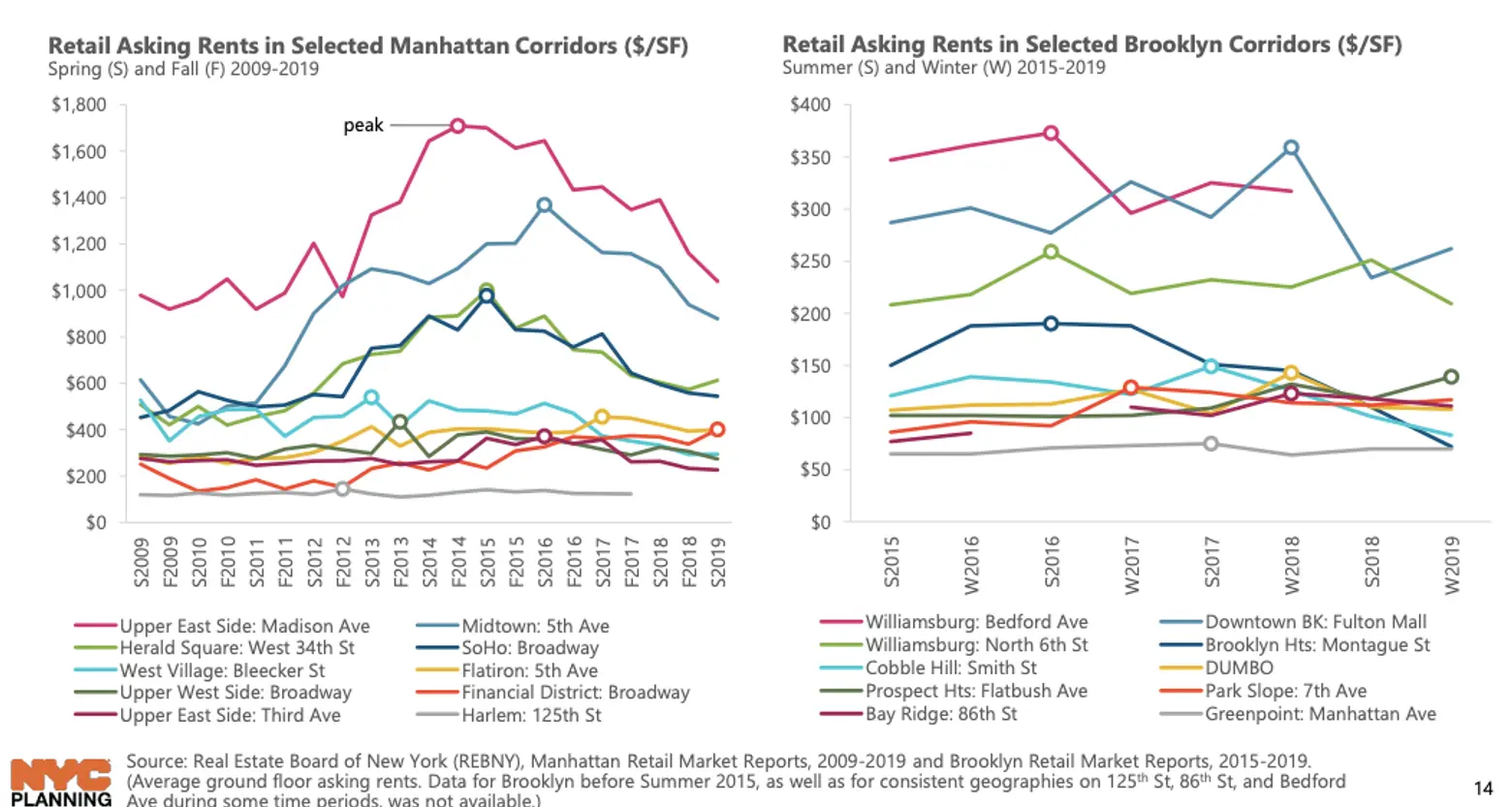

Competition is another factor: Storefront space has grown significantly. Some corridors in Manhattan and Brooklyn saw a rent bubble post-recession; farther from Manhattan, rents were more stable, the study found.

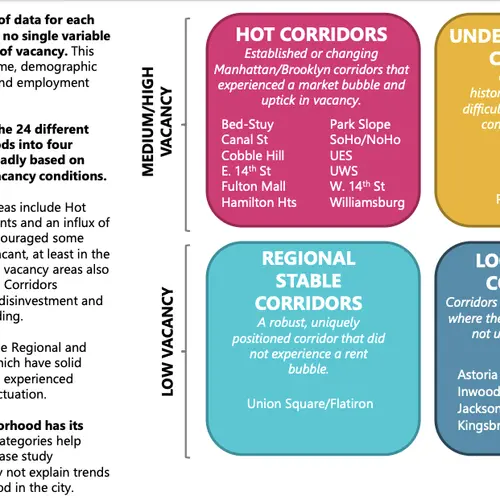

Takeaway #2: Vacancy rates are volatile and vary from neighborhood to neighborhood and street to street; they can’t all be explained by any single factor. To separate the reasons for storefront vacancies in such a wide variety of neighborhoods, a deeper dive is definitely necessary. In SoHo/NoHo, for example, the high vacancy rate is due to a unique mix of factors–not just soaring rents.

Brownsville, on the other hand, had about the same vacancy rate as SoHo/NoHo, but for completely different reasons. And on Canal Street–which led the city in vacancy according to the study–vacancy may be partially due to redevelopment and restrictive regulations.

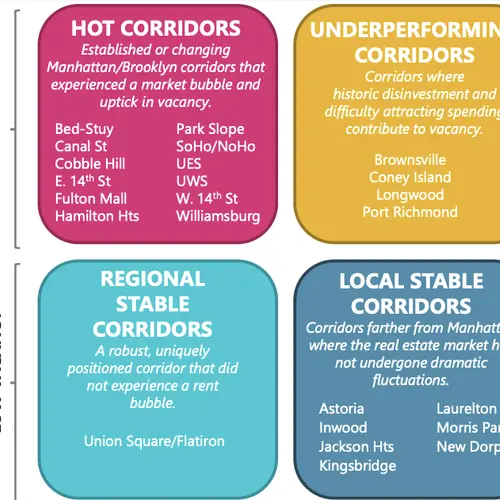

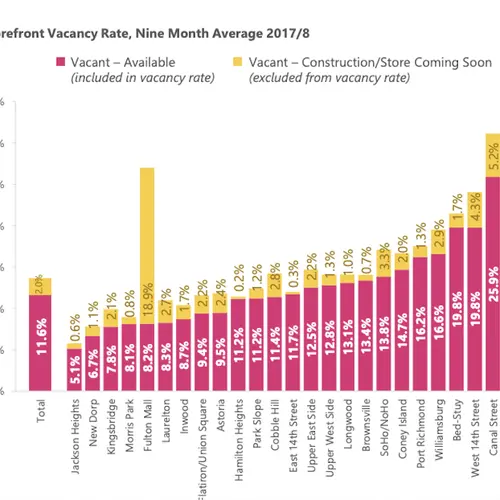

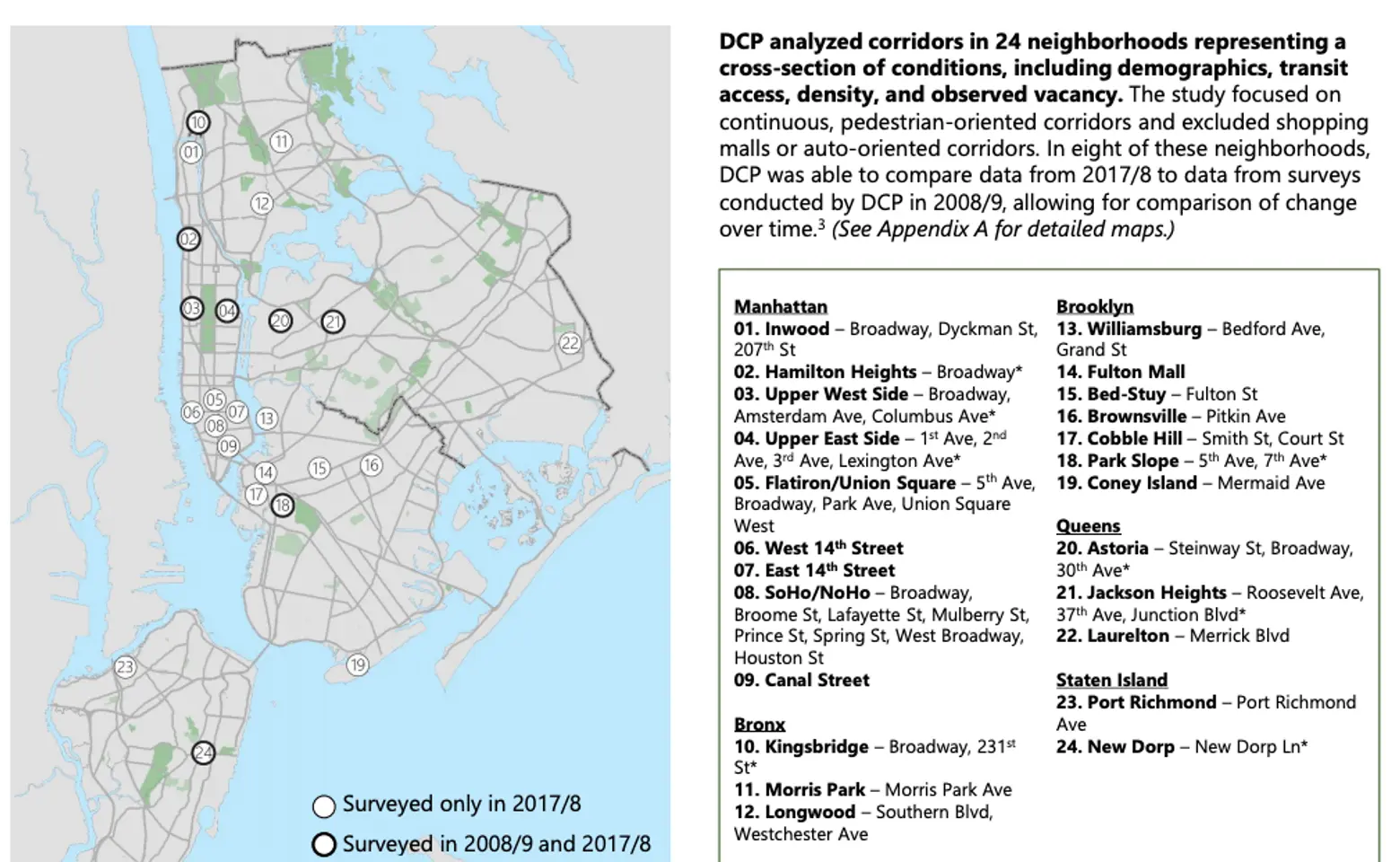

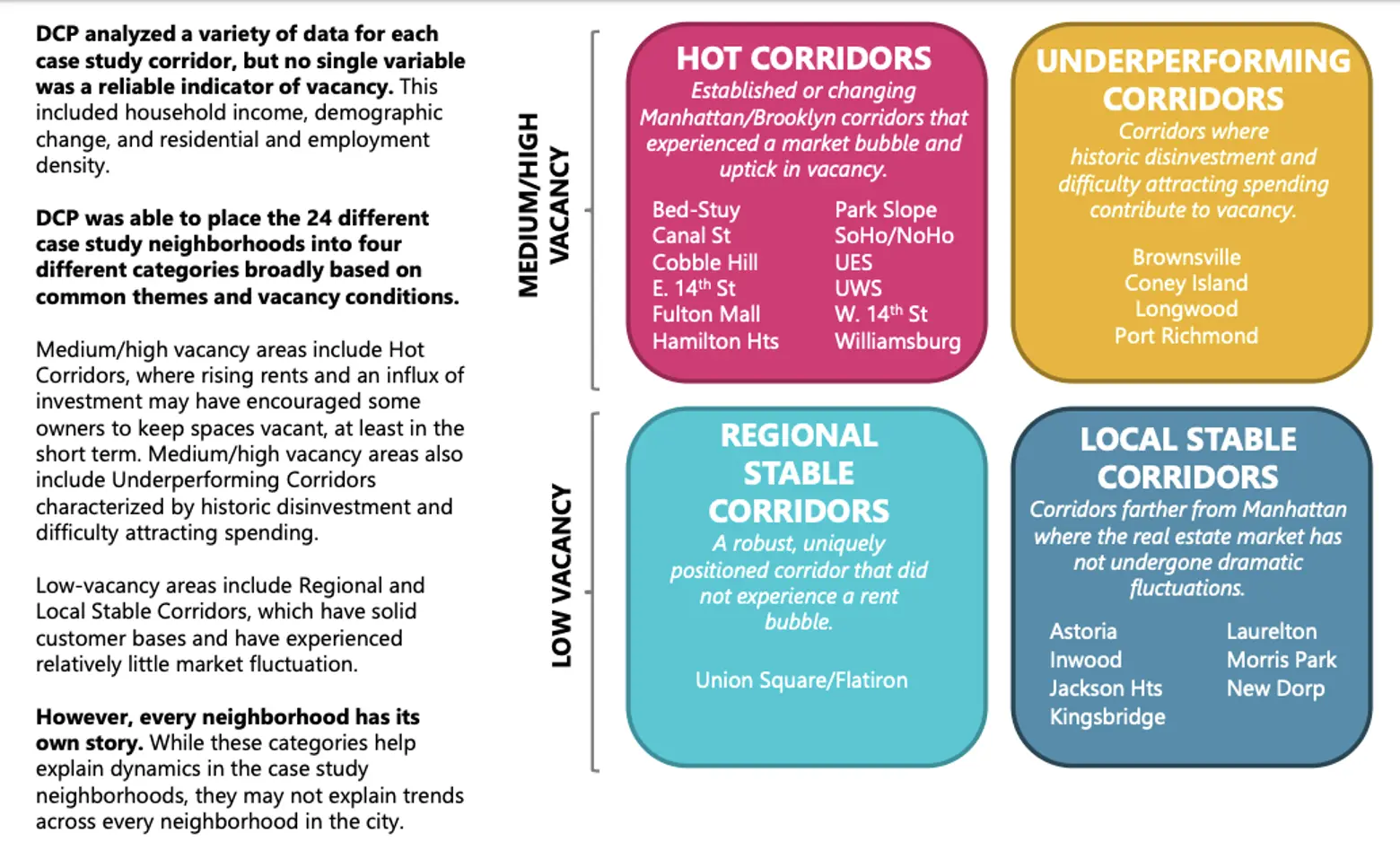

Recognizing that every neighborhood is unique, DCP analyzed corridors in 24 neighborhoods based on common themes and vacancy conditions and representative of a cross-section of conditions like demographics, transit access, density, and observed vacancy. The 24 neighborhoods were divided into four groups, half with a high rate of retail vacancy, half with a lower rate to help explain the neighborhoods’ retails shifts.

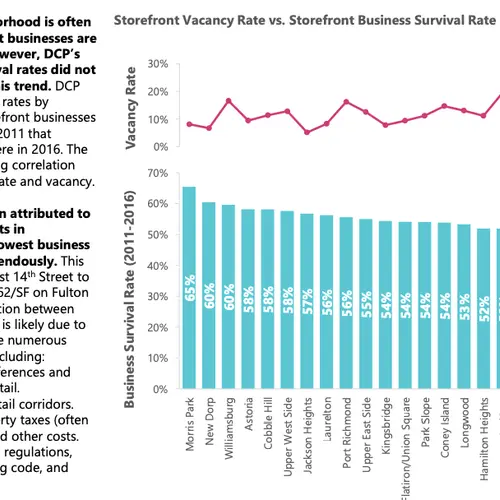

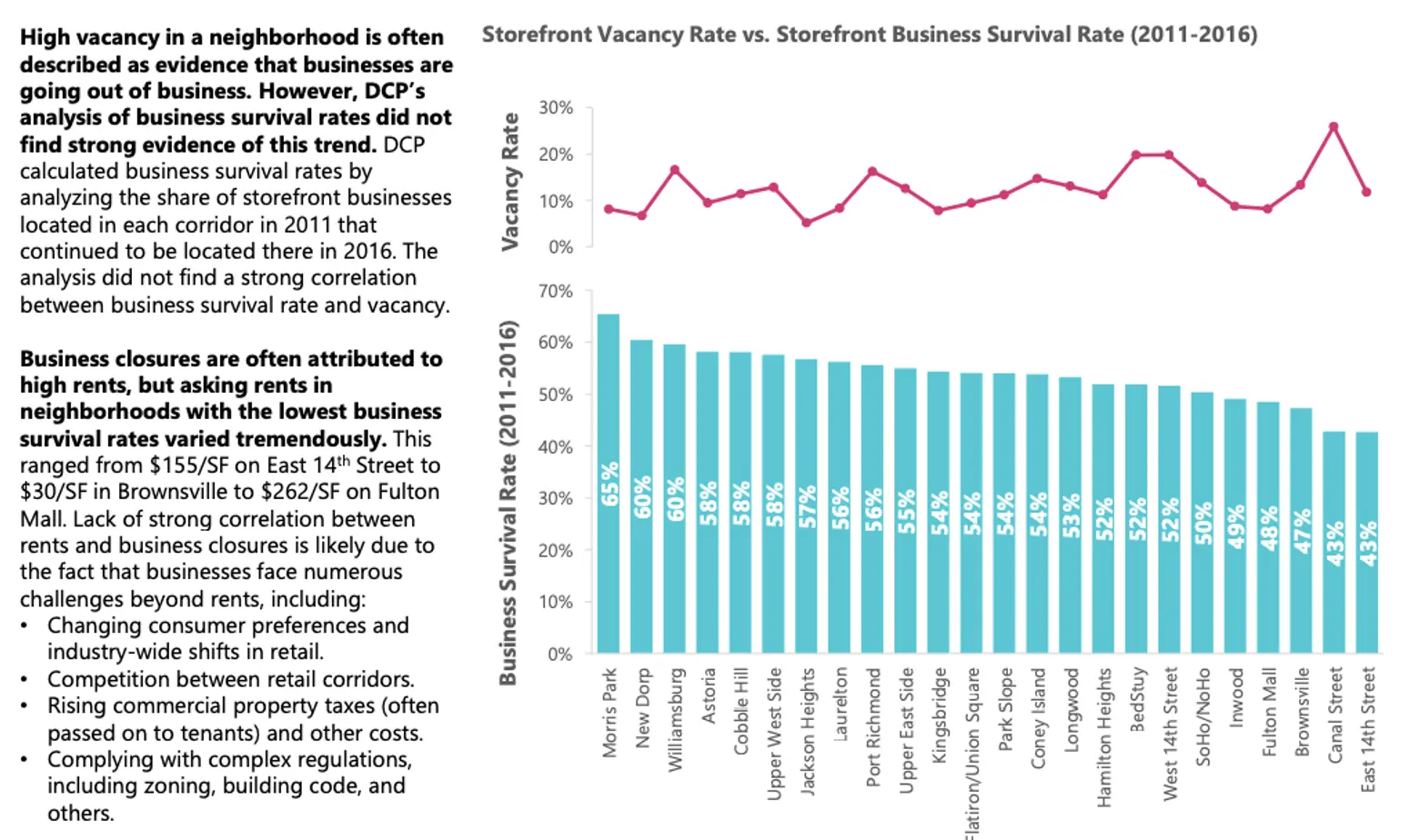

Takeaway #3: Vacancy is concentrated only in some neighborhoods; its presence is influenced by local and citywide market forces and spending patterns. Also, the vacancy rate does not necessarily correlate with business survival rates. But the study found that vacancy rates have not increased significantly overall in the past 10 years within the corridors surveyed in 2008-09.

RELATED:

- First database in the country to track retail vacancies gets green light from NYC Council

- Vacant New York: Mapping all of Manhattan’s empty storefronts

- De Blasio is considering a vacancy tax for landlords who leave their storefronts empty

- Brookfield hopes to rescue retail on Bleecker Street with purchase of seven storefronts

Charts/infographics via DCP.