New data from Comptroller Scott Stringer shows that affordability is still declining in New York

Image via Flickr cc

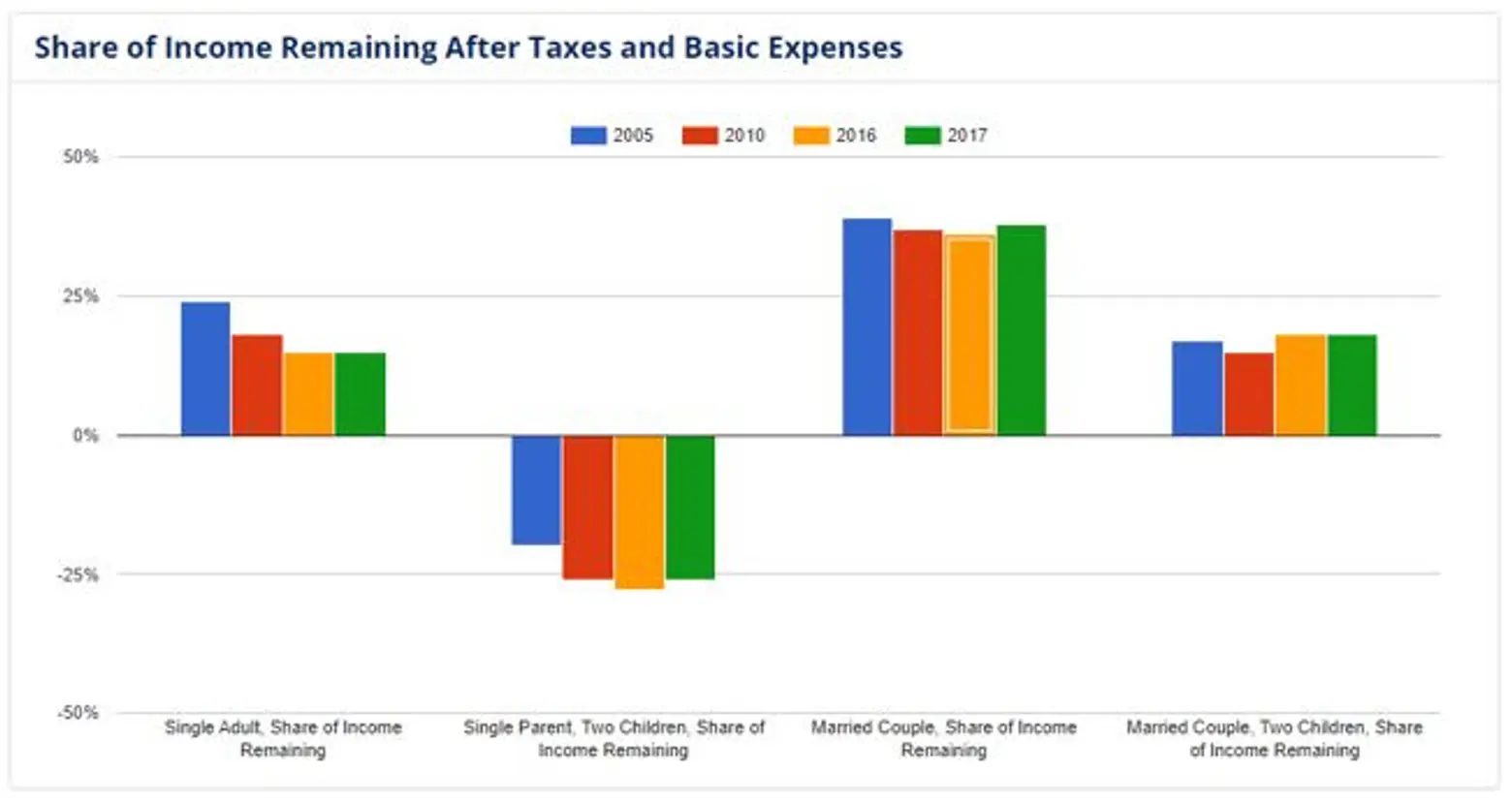

City Comptroller Scott Stringer has released an updated Affordability Index, an annual look at how the rising costs of basic necessities like housing, transportation, healthcare, and childcare, are squeezing the budgets of New York City households and leaving them with fewer savings. Like last year, the data is far from reassuring, demonstrating that expense costs are rising far more rapidly than incomes. In 2005, the average middle-income single adult had 24 percent of their income left over after expenses. In 2017, that dropped to only 15 percent.

“Over the last decade, the lack of affordable housing and the soaring cost of everything from childcare to basic everyday necessities have ravaged New Yorkers’ bank accounts, and now, these pressures are pushing people out,” said Stringer in a statement. “This data shows exactly why we need an affordable housing plan that puts people before profits and bold investment in quality affordable childcare. We can’t allow a two-million dollar luxury condo to become the entry price to New York City. We need to meet this growing crisis with the urgency it demands and do everything in our power to keep New York City an aspirational city for our next generation.”

Graph by the office of the Comptroller

This year’s report calculated a basic budget for four household types based on middle income for the year 2017: single adults, married couples with no children, single parents with two children, and married couples with two children. Between 2005 and 2017, typical household incomes increased by just 1.9 percent per year for single adult households, while expenses increased at a faster rate: Median rents have gone up on average 4 percent a year, food costs have increased by 2.1 percent, transportation costs by 3 percent, healthcare costs by up to 6 percent, and childcare costs have risen roughly 2.4 percent each year.

Single parents with two children still struggle the most to afford to live in New York City and have significant trouble paying for basic necessities. For these households, the costs of basic expenses actually exceeded incomes by 26 percent in 2017.

The insight from this tool could be used to guide policy decisions. For example, the data shows that housing takes up 37 percent of the average single adult’s income, a whopping 47 percent of the average single parent’s, but only 17 percent of the average married couple without kids, and 20 percent for the average married couple with children. That makes what many have already been thinking plain as day: affordable housing is urgent for people with moderate and low incomes, not those who make more than six figures.

Explore the interactive report here.

RELATED: