2018 Manhattan condo sales show volume drop and price cooldown from last year’s soaring heights

Rendering of 200 East 59th Street via Studio amd for Macklowe Properties

Rendering of 200 East 59th Street via Studio amd for Macklowe Properties

CityRealty’s new 2018 year-end market report reveals trends in Manhattan real estate including a notable drop in transaction volume and a decline in condo sales prices after 2017’s roaring gains. Co-ops showed marginal gains in 2018. The New York Times refers to the report and quotes Jonathan J. Miller of Manhattan’s Miller Samuel appraisal firm: “Sales are not low–they are just not unusually high. It’s like we came off the autobahn: It feels very slow relative to the last three to four years, but historically it’s not.” See a few highlights from the report, below.

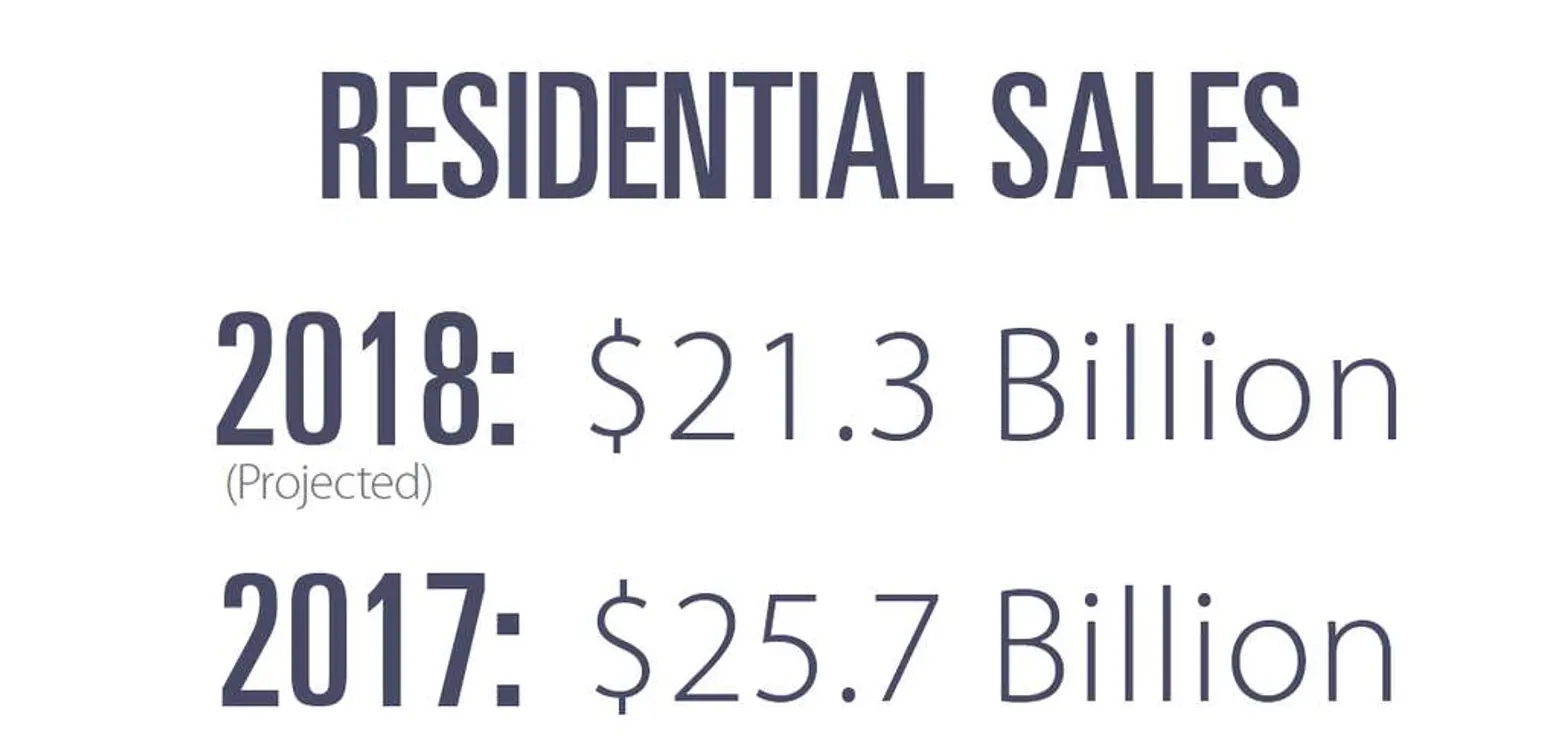

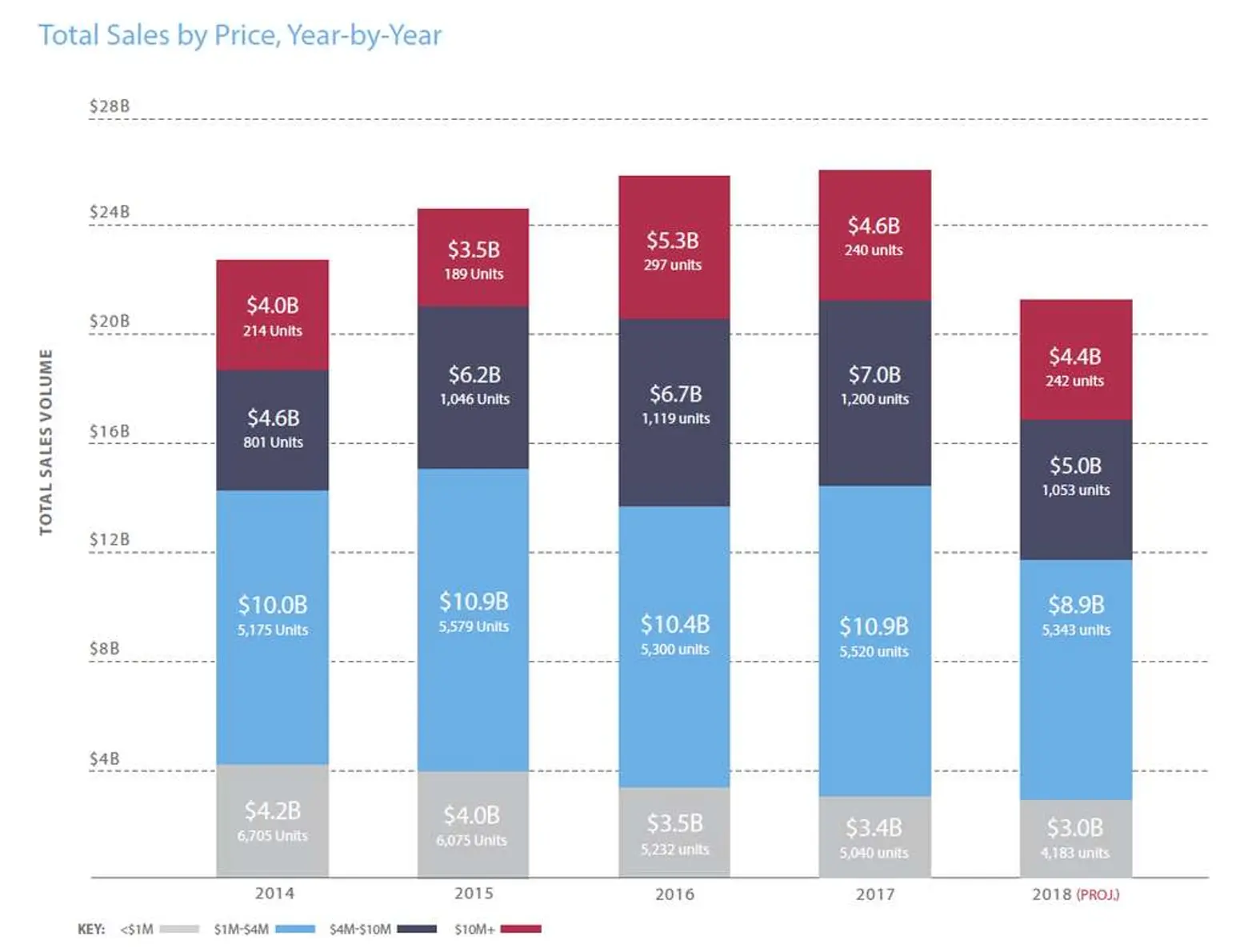

The median sales price of all apartments in 2018 was $1.2 million, down from $1.25 million in 2017. The projected sales volume for co-ops and condos is $21.3 billion for the year (based on the $18.9 billion recorded through November 30 and accounting for seasonality and properties in-contract). The $21.3 billion projection shows a substantial slide from last year’s total recorded sales volume of $25.7 billion.

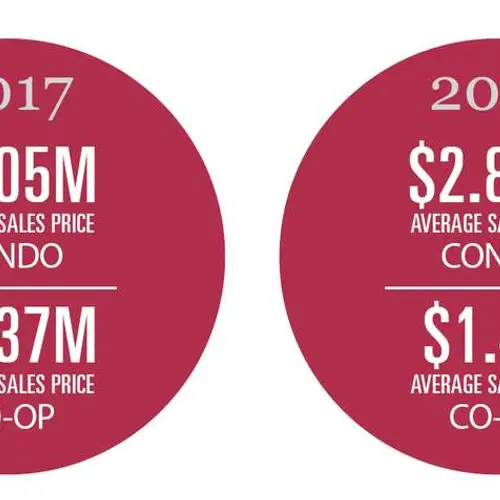

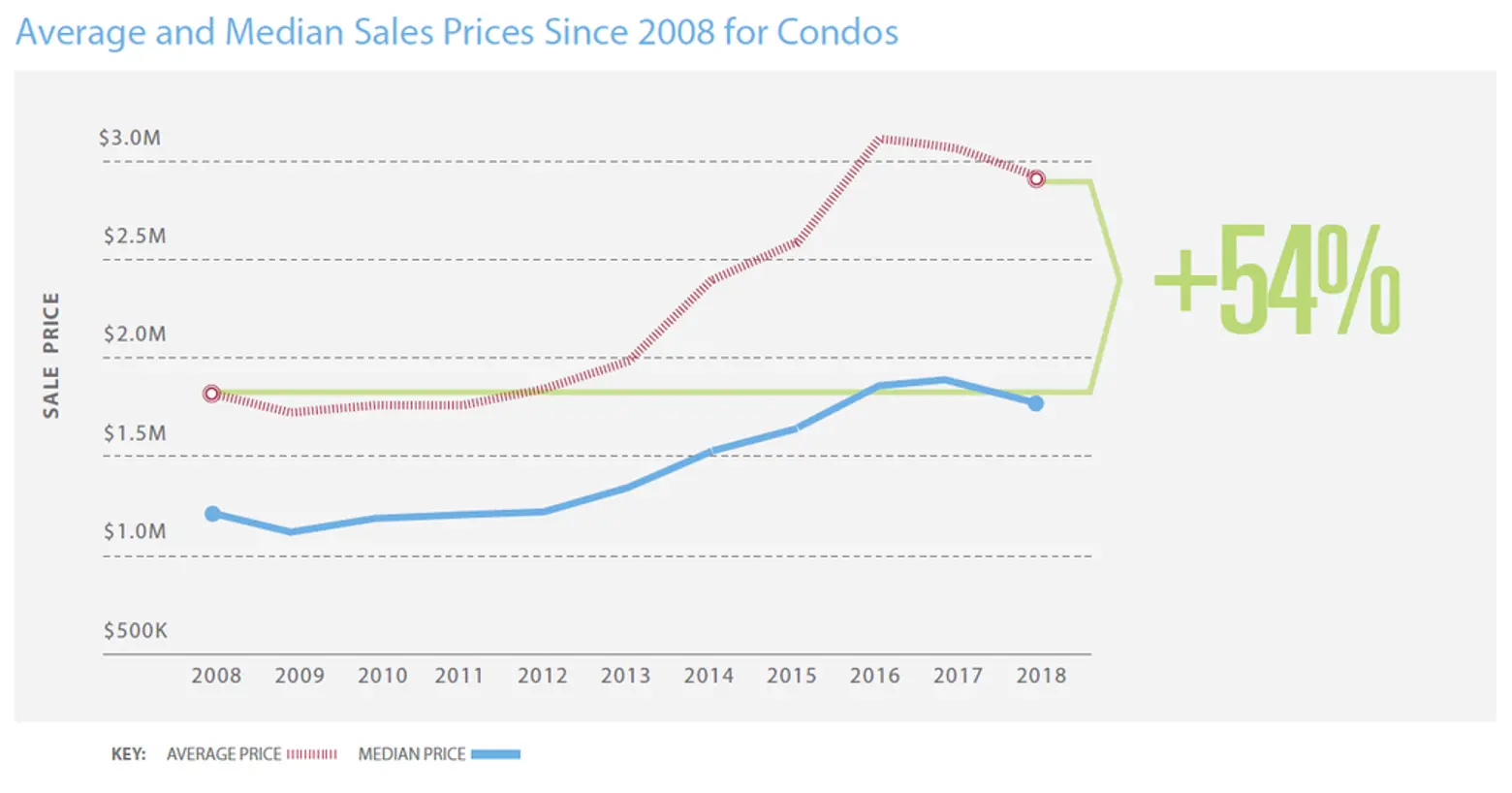

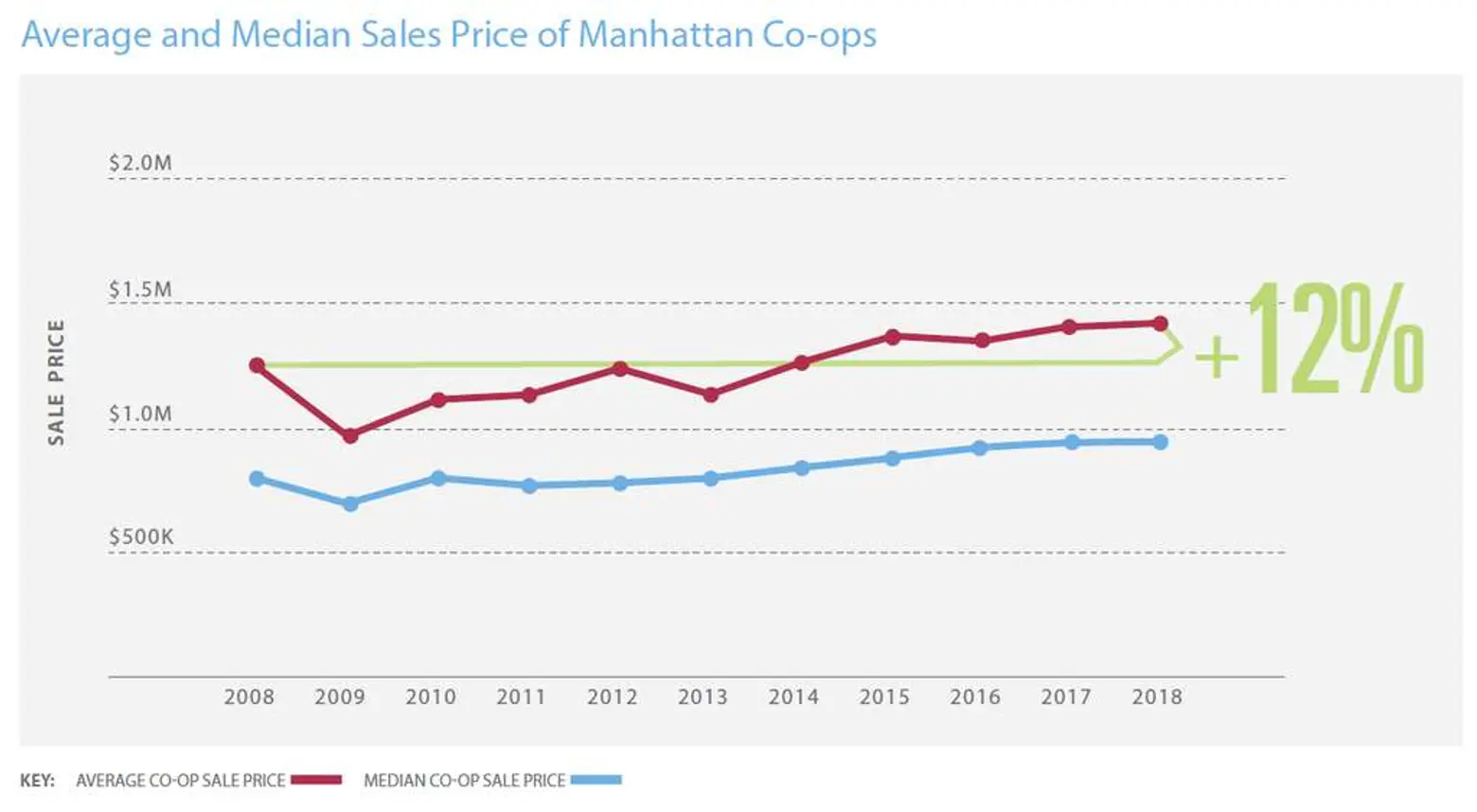

The $2.88 million average price of a condo in 2018 was down from $3.05 million the year prior, with the average price per square foot down slightly to $1,802 from $1,861 in 2017. Prices climbed slightly higher in the Manhattan co-op market: The average price paid for a co-op was $1.4 million, up from $1.37 million in 2017.

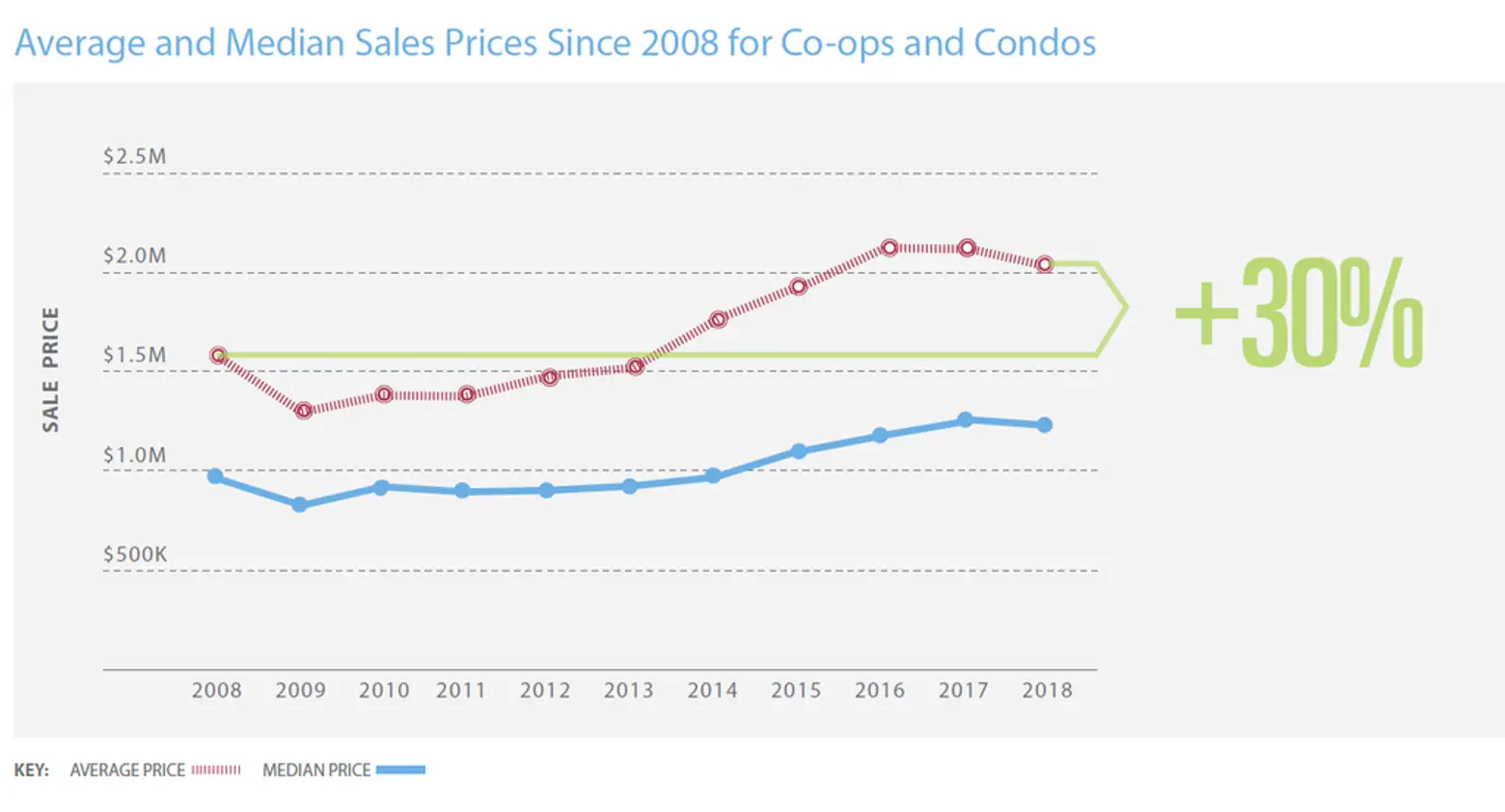

The average and median Manhattan sales prices for both condos and co-ops have, however, increased significantly when compared with 2008 prices. This year’s average condo/co-op apartment price of $2.06 million is 30 percent higher than it was in 2008, and the 2018 median price of $1.97 million is 25.3 percent higher.

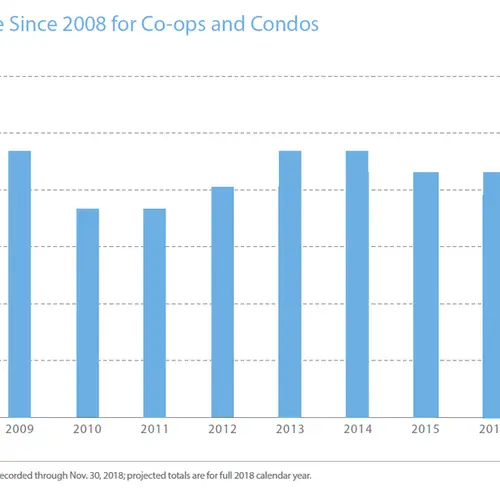

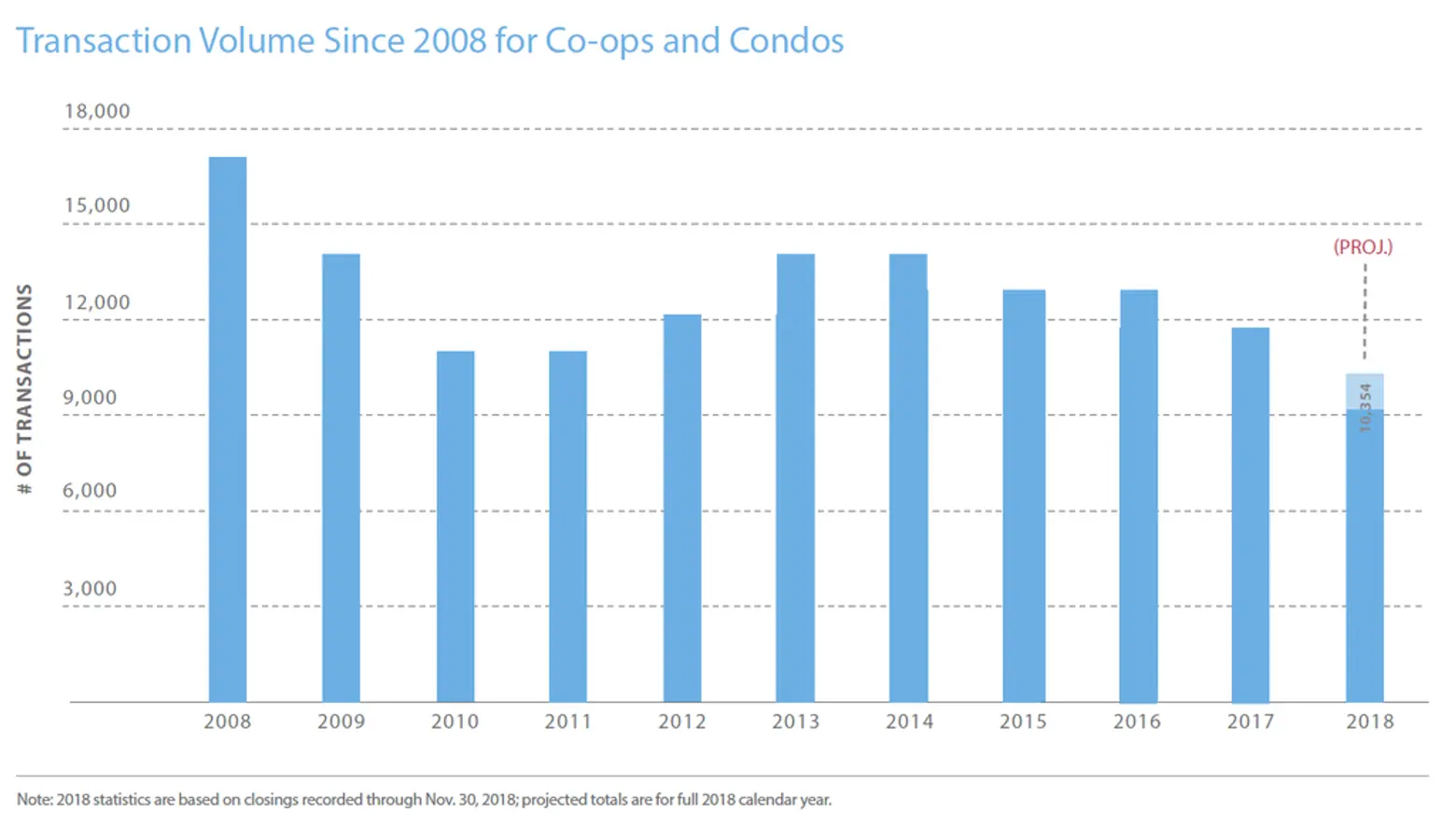

There were 9,157 co-op and condo closings recorded in the first 11 months of 2018. projections show 10,354 sales through the end of 2018, a substantial decrease in transaction volume from the 11,881 sales recorded in 2017.

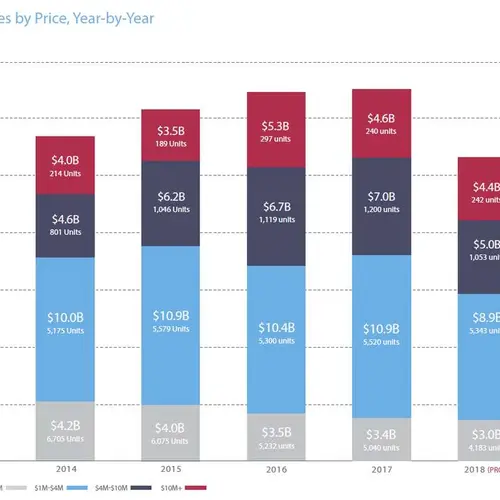

The chart below illustrates the rise in sales of high-priced units over the past five years. Sales volume by dollar amount is down by 17 percent when compared to 2017, with a projected sales volume of $21.3 billion for 2018. Looking at apartments over $10 million, total sales volume is projected to reach $4.4 billion through the end of 2018. The number of apartment sales at this premium price level is down from 2017’s sky-scraping $4.6 billion, but the aggregate sales total still accounts for 20 percent of Manhattan residential real estate spending this year, spread over just 242 sales.

The average price of a Manhattan condominium was $2.90 million through November 30, a 58 percent increase from 2008’s $1.84 million average. The median sales price for condos, $1.72 million, has increased 42 percent since 2008, when it was $1.21 million.The average price-per-foot for condos, $1,802, was down from last year’s average of $1,861.

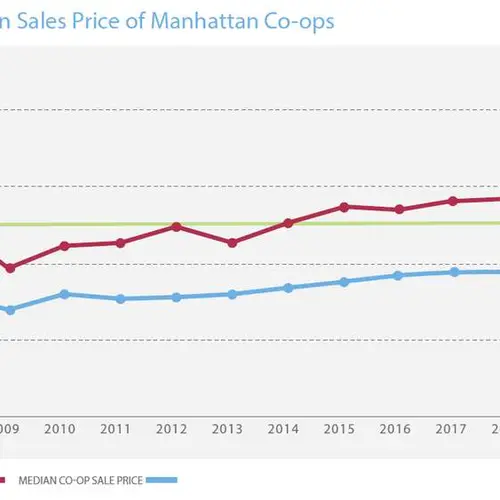

The average sales price for co-ops through November 30 was $1.40 million, up from $1.37 million last year. The median sales price was also up, at $855,000 compared to last year’s $845,000. A projected total of 5,838 co-ops will close through the end of the year, down 15 percent from 6,267 in 2017.

In 2018 the Nolita/Little Italy neighborhood was the top price gainer, rising 20 percent in 2018, more than any other neighborhood. This increase is largely attributable to closings in the new building at 152 Elizabeth Street, including a penthouse which sold for $29.95 million ($5,603 ft²).

All things Trump (in Manhattan real estate)

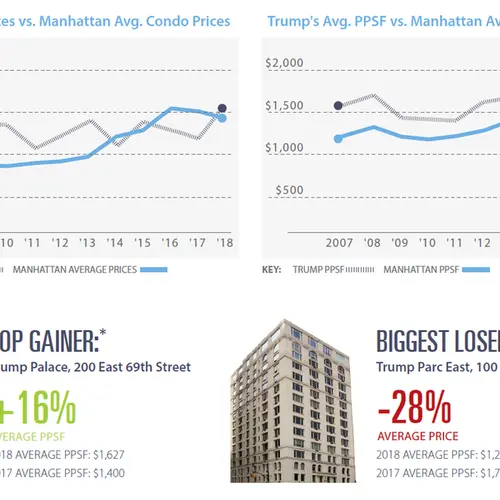

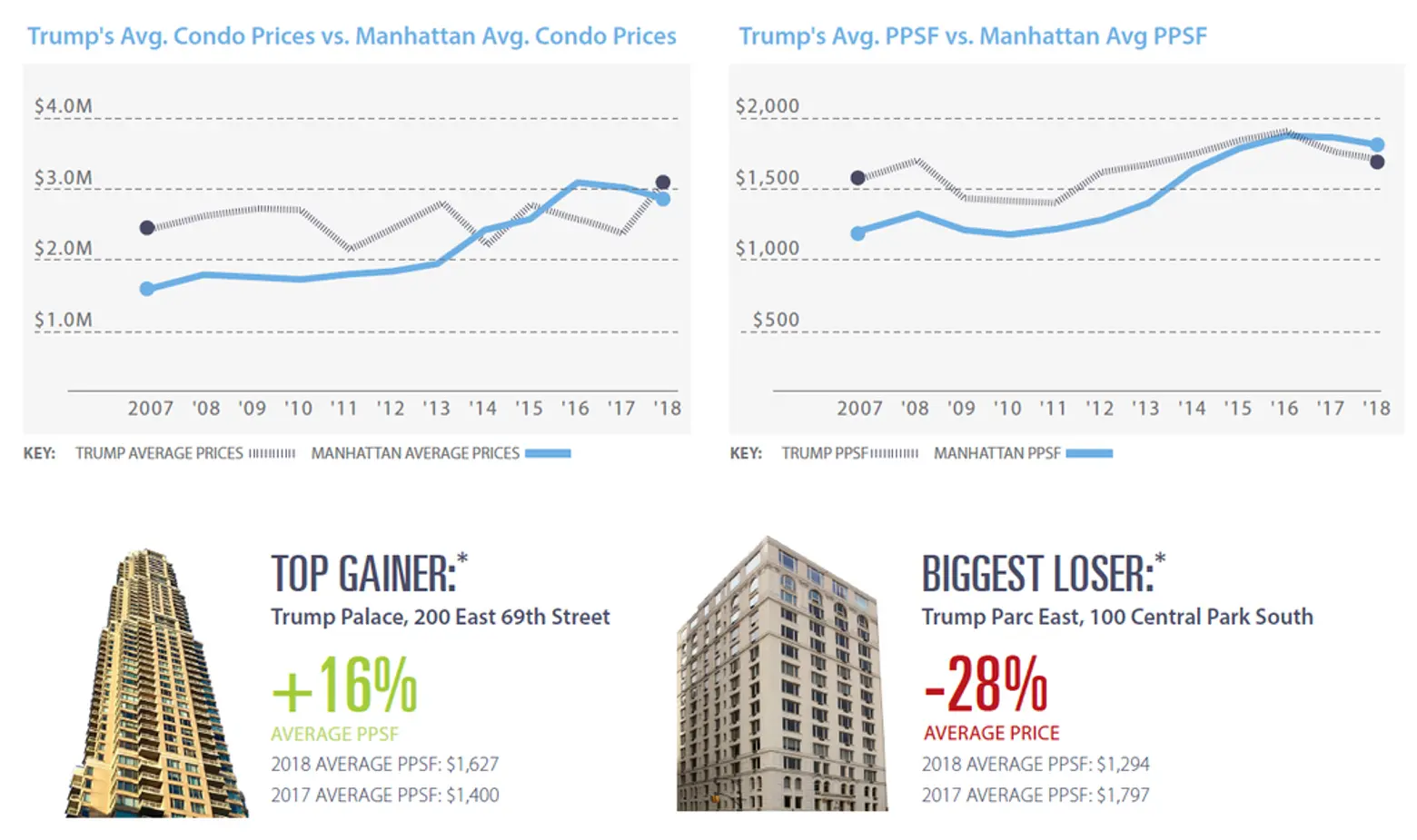

In the second full year of Donald Trump’s presidency, the average sales price for Manhattan’s 11 Trump-branded condos was above the Manhattan condo average. However, the price per square foot paid in Trump buildings lagged. The average price paid for a Trump condo rose significantly to $3.12 million ($2.89 million was the Manhattan average); the average price per square foot in Trump condos fell from $1,749 in 2017 to $1,711 in 2018.

New development sales are projected to reach about $4.98 billion through the end of 2018, down from the $8.9 billion in new condo sales recorded in 2017. About 1,050 new condo sales are expected to be recorded through the end of 2018 compared to 1,848 last year.

Average prices at new developments fell to $4.54 million in, down from a record high of $5.16 million in 2016. Though the new development market’s performance has been volatile year-over-year when compared to the steady growth of non-new development condo sales, the average price represents a 131 percent increase from the average price of $1.59 million 10 years ago. A projected 1,050 new development sales will be recorded through the end of 2018, down from the 1,848 recorded in 2017.

[Via CityRealty]

Charts via CityRealty.

RELATED: