Comptroller wants on-time rent payments to count towards credit scores

Photo via Wikimedia

City Comptroller Scott Stringer unveiled a plan on Monday that would allow renters in New York City to count on-time, monthly payments toward their credit score. While homeowners who punctually pay a mortgage can boost their credit, renters currently cannot count on-time payments in the same way. Those without credit or bad credit often pay higher interest rates on loans and other monthly bills, like utilities or cell phone payments. As the New York Times reported, Stringer’s office looked at a sampling of tenants who pay less than $2,000 per month and found that 76 percent of them would improve their credit scores if rent payments were reported. Stringer told the Times that his plan “could create a powerful credit history that could lift you out of poverty.”

Courtesy of NYC Comptroller’s Office

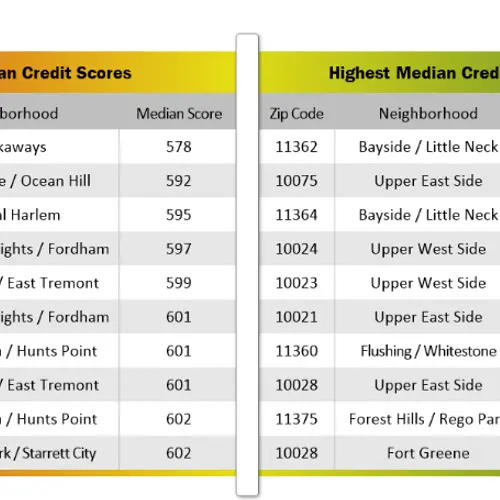

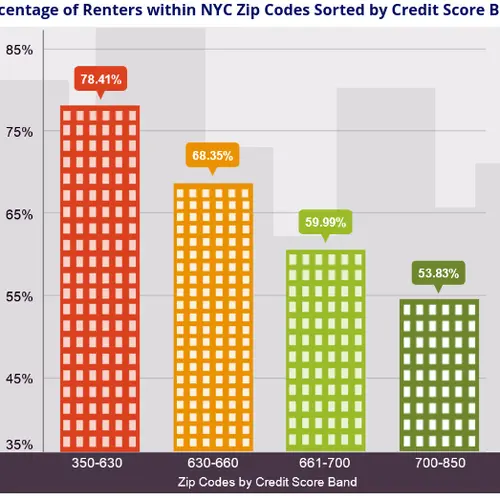

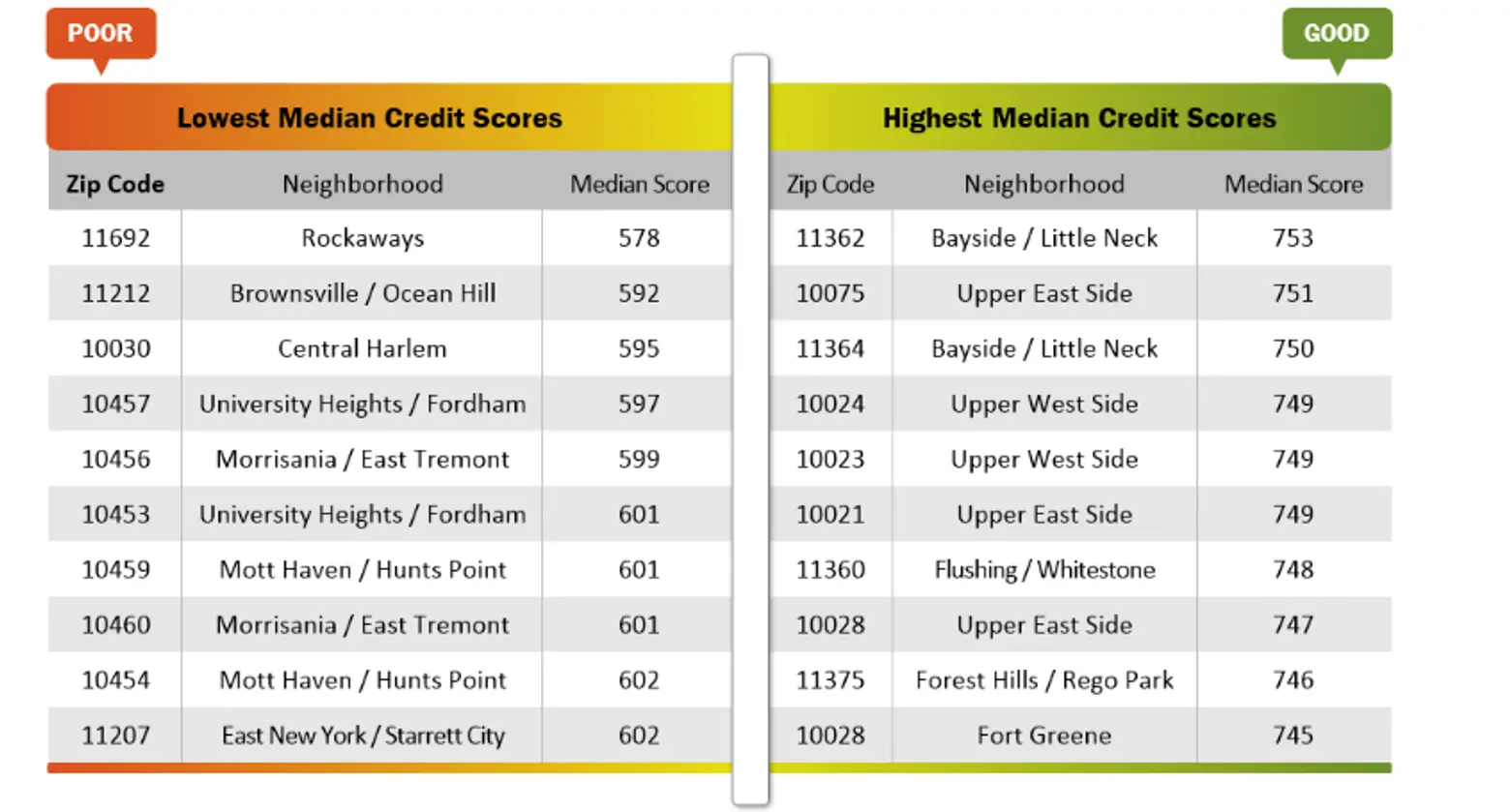

Stringer’s plan, titled “Make Rent Count,” would encourage landlords and property management companies to give tenants the chance to opt-in to have their rent payments reported as an opportunity to increase credit scores. Known as the “credit invisible,” people without any credit or bad credit are typically targeted by subprime lenders, who can legally add “risk-based” charges. The comptroller’s office found that a majority of those considered credit invisible in New York include black and Hispanic renters.

Courtesy of NYC Comptroller’s Office

The proposal would expand the New York City Housing Authority’s current pilot program that allows tenants to report their rent payments. However, just one person participates in the program, a senior adviser at NYCHA told the Times. Plans are in the works to recruit the nearly 7,000 residents that live in Queensbridge Houses, the country’s largest housing development, to report rent payments.

Courtesy of NYC Comptroller’s Office

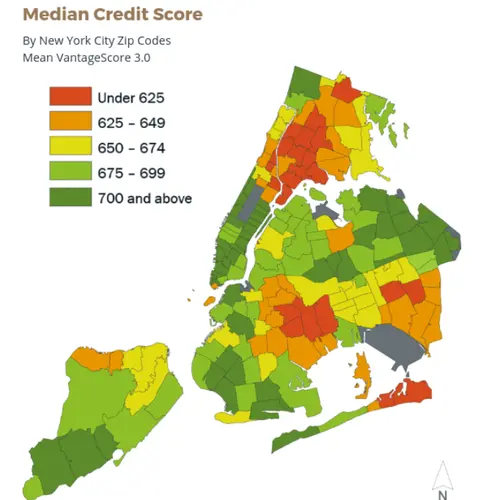

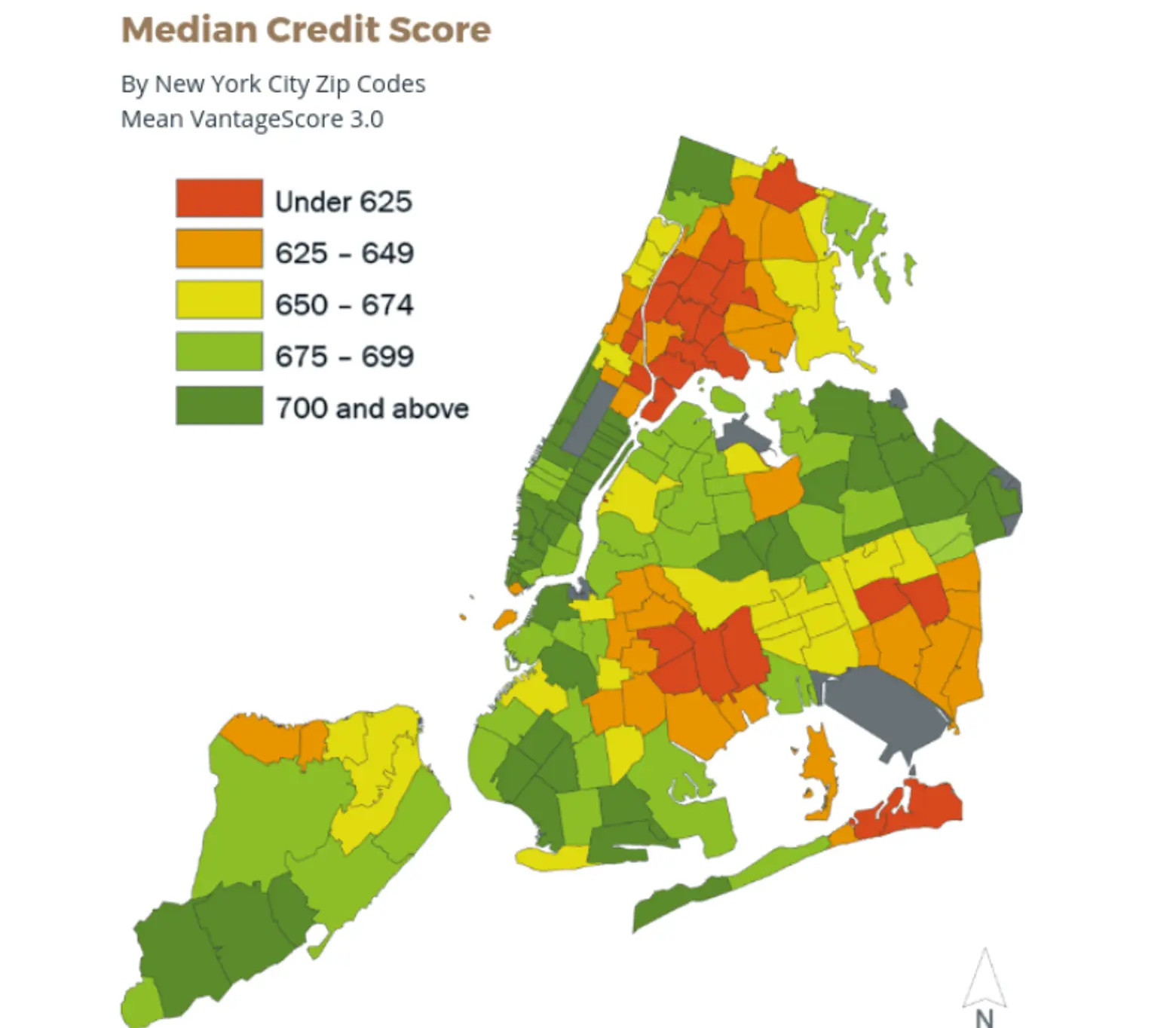

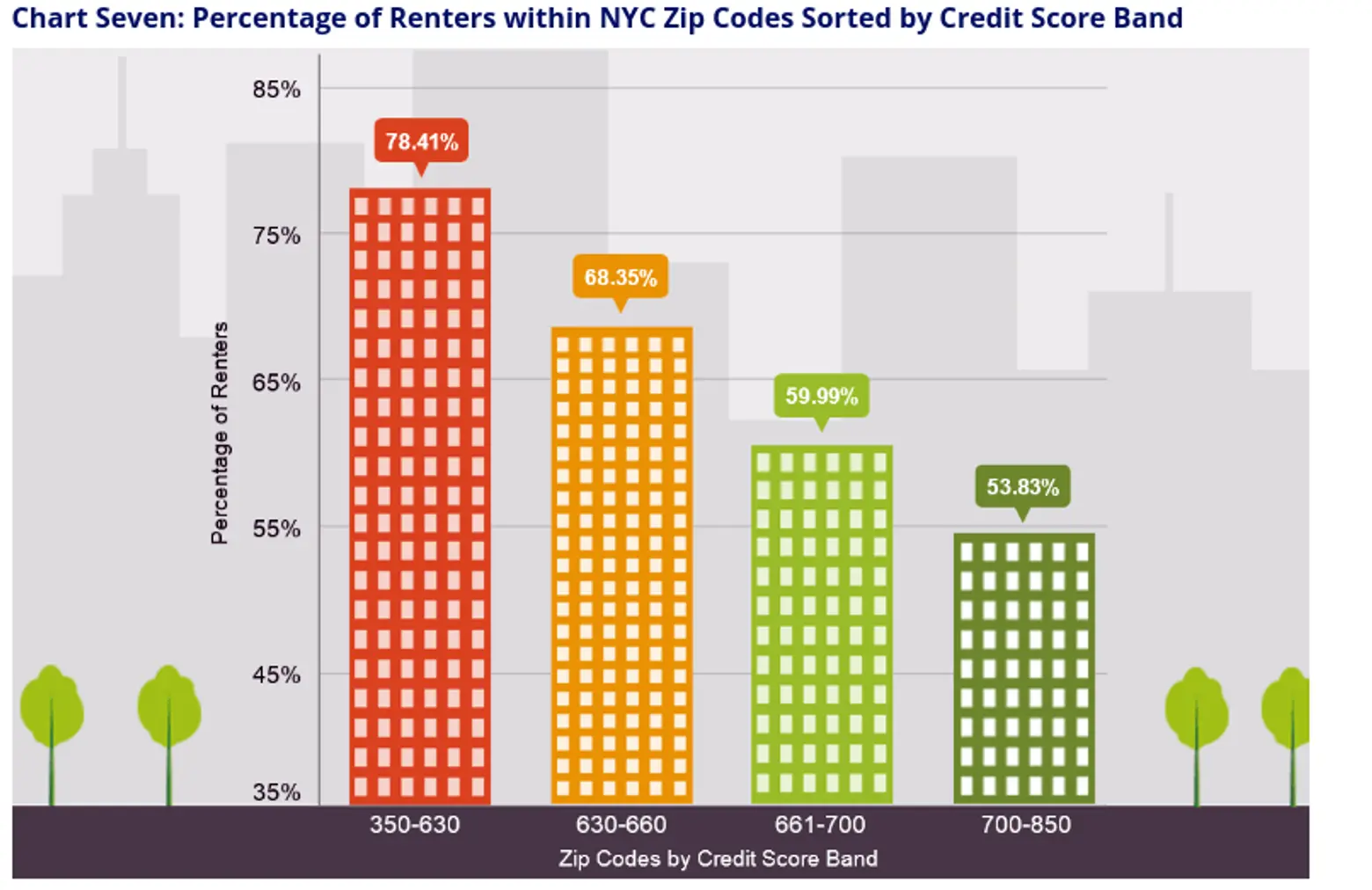

According to the report from Stringer’s office, in zip codes with one in ten residents living in a NYCHA-operated development, the average credit score was less than 630. The city’s average credit score stands at 673. The report found that neighborhoods with a lot of renters or with a high number of low-income residents reported lower credit score than communities with more homeowners.

Since 2010, the credit rating firm Experian has run a program that makes it easy for landlords to report the rental payments of their tenants. While this has given renters the opportunity to build a credit history, it also allows landlords to stand out from other rental buildings on the market. Despite the clear benefits, the program has not been broadly implemented.

Read the comptroller’s report here.

[Via NY Times]

RELATED: