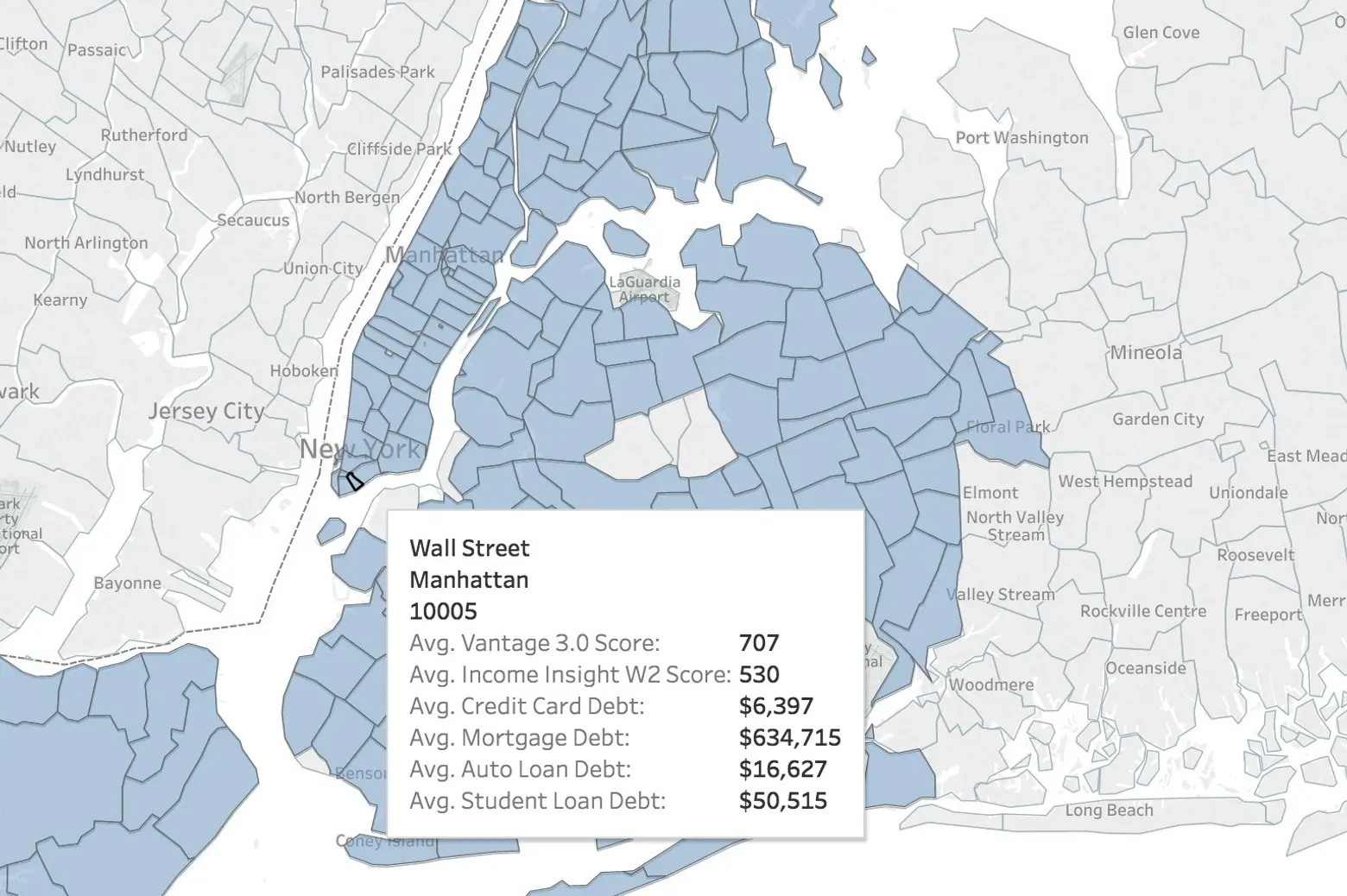

This interactive map lets you find out your neighbors’ finances

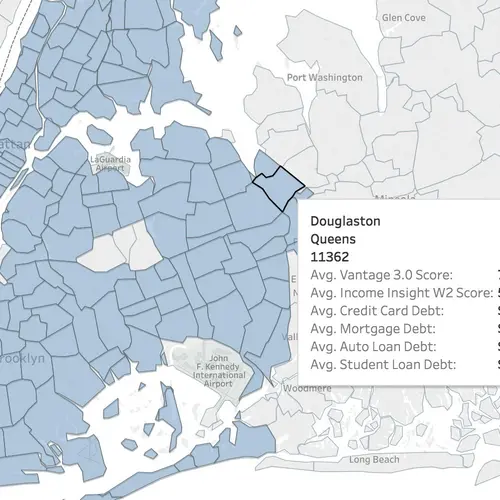

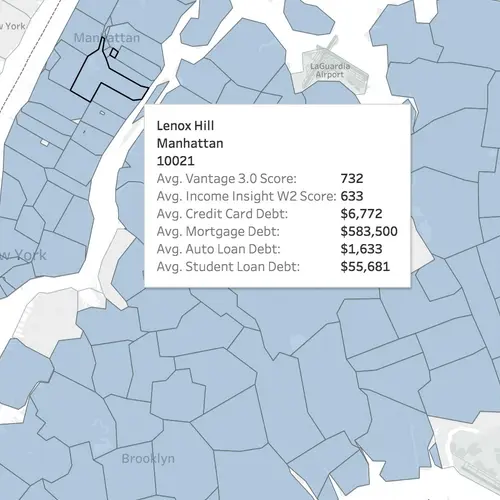

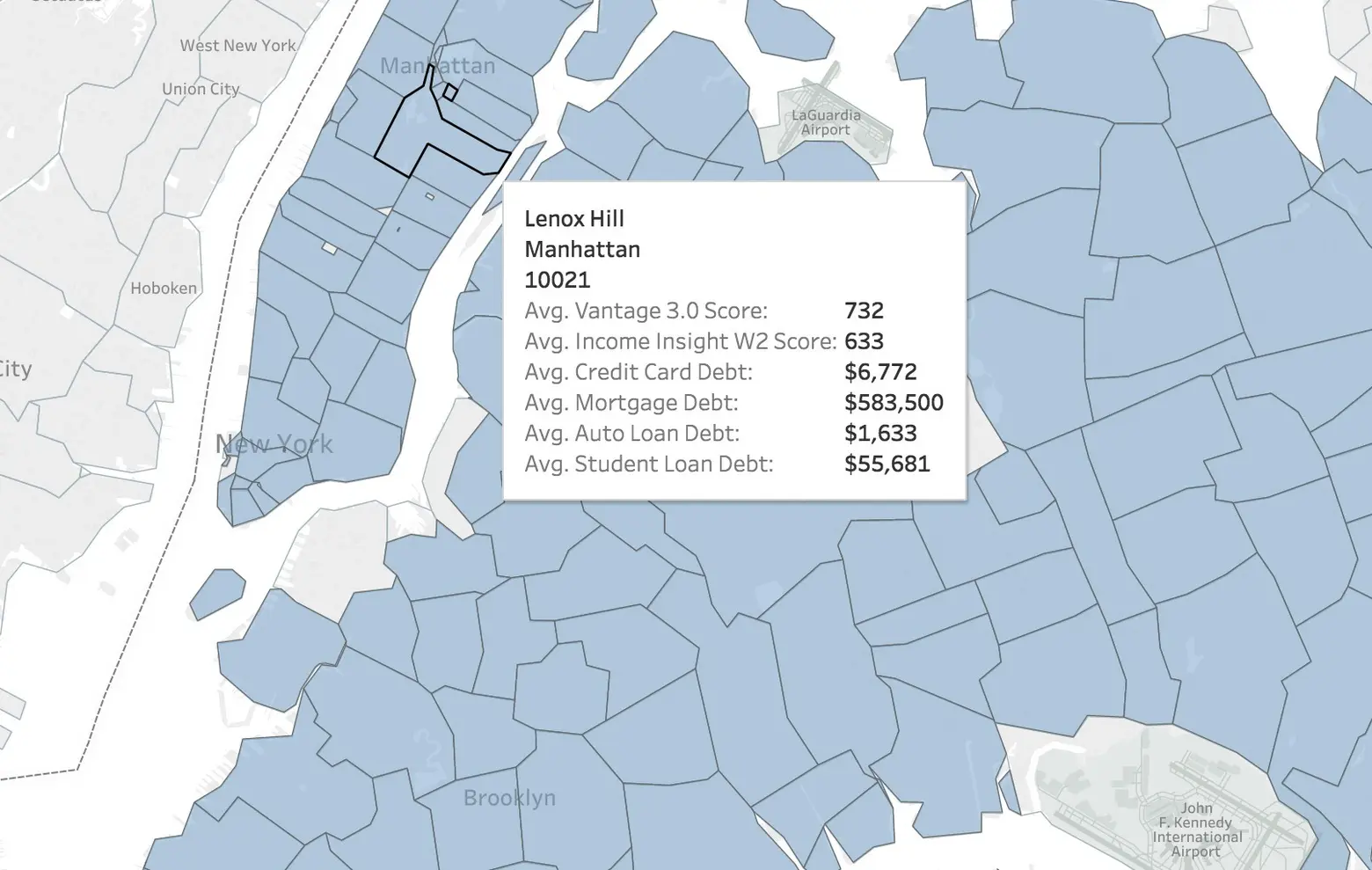

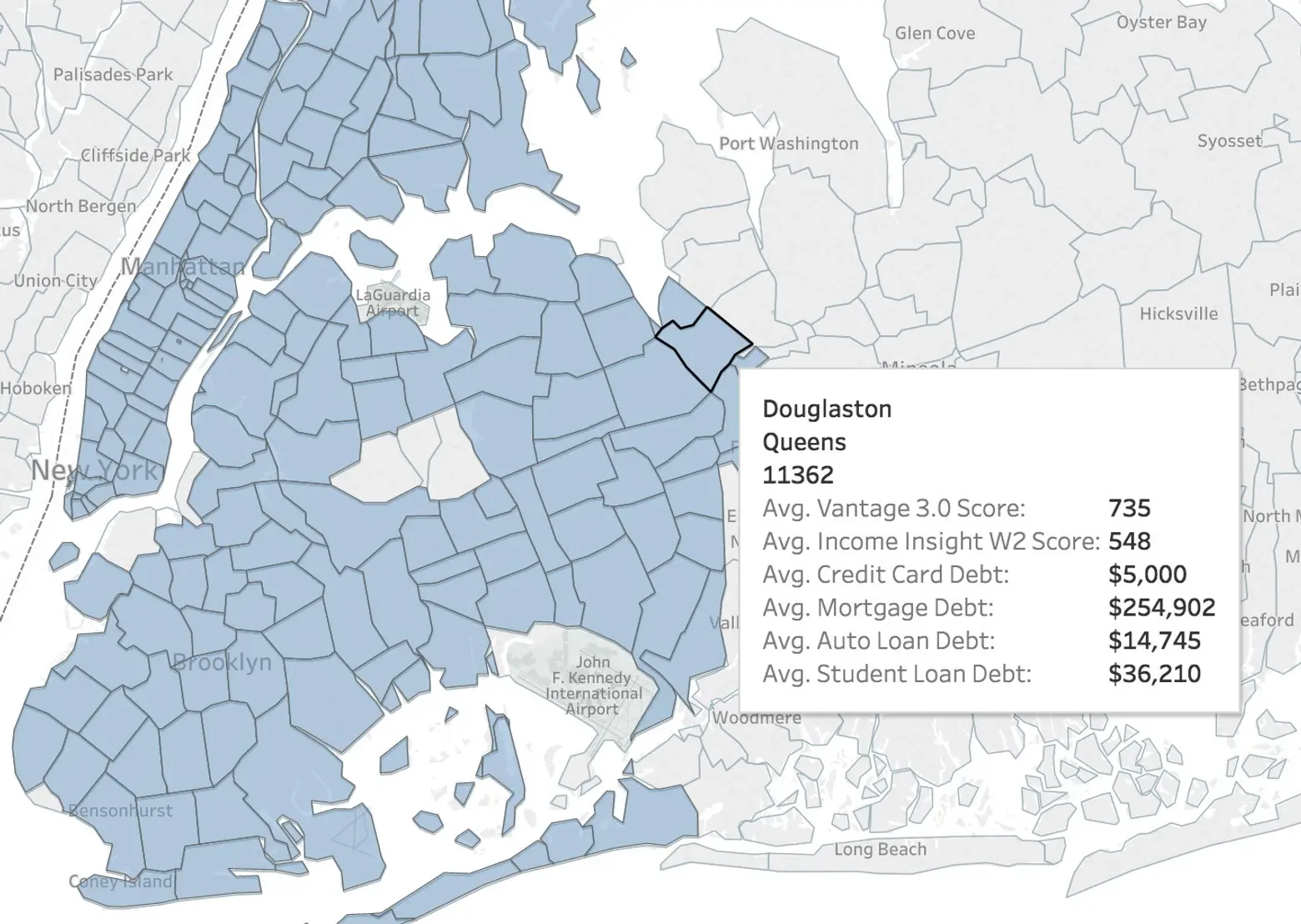

Designed for the busybody in all of us, a new interactive map provides information about our neighbors’ finances. Designed by student loan marketplace LendEDU, it shows the average income level, credit card and student loan debt, mortgage debt, and auto loan balances in every NYC neighborhood (h/t Brick Underground). While the Upper West Side, Tribeca, Battery Park and Lenox Hill all made the list for highest-earning areas, the highest credit ratings were all in Queens; Breezy Point, Douglaston and Clearview all had some of the best credit scores.

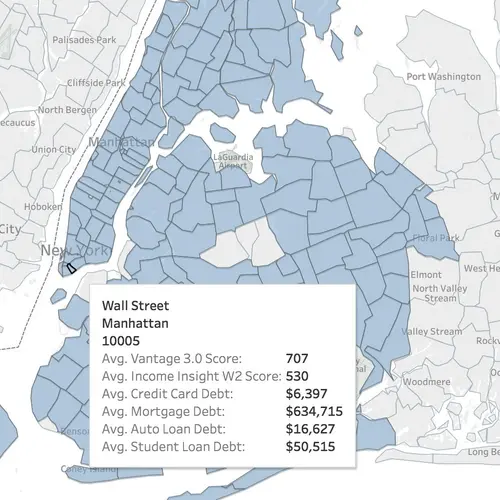

Experian supplied LendEDU the data and the company found that some of the highest-earning neighborhoods had the highest credit card balances and mortgage balances. Having a high mortgage balance in neighborhoods like Battery Park and Tribeca isn’t all that surprising due to the sizeable costs of homes in these areas.

Shockingly, wealthy neighborhoods also made the list of highest student loan debt in the city. Areas like Hunters Point, Lenox Hill, the Upper West Side, Yorkville and Wall Street have a lot of residents still paying off plenty of student loan debt. Despite residents earning more and potentially having more resources to pay off debts, these neighborhoods still have a hefty sum to pay back. Mike Brown, a LendEDU research analyst, found this data surprising. “I would have assumed residents in those neighborhoods would have the resources to pay off their loans more quickly,” says Brown. “But it could be that more residents in Manhattan, for instance, might be going to a secondary program after undergrad, like law school.”

In addition to letting us all be a little bit nosy, the map also provides a good tool to use before moving into a new neighborhood. By looking at its economic picture as a whole, including average mortgage balances if considering buying a new home, it makes it easier to see if the neighborhood is affordable. Explore LendEDU’s interactive map here.

RELATED: