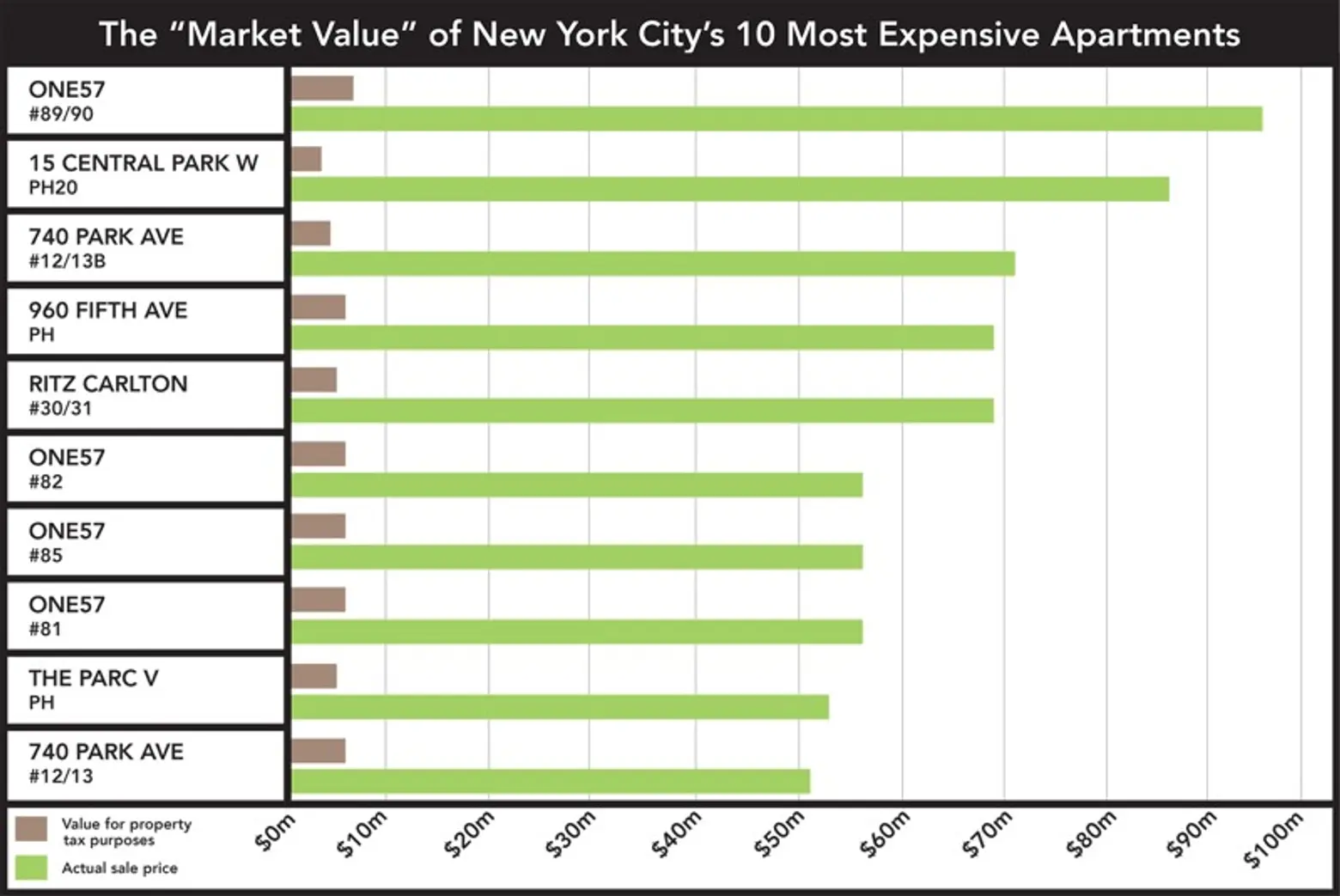

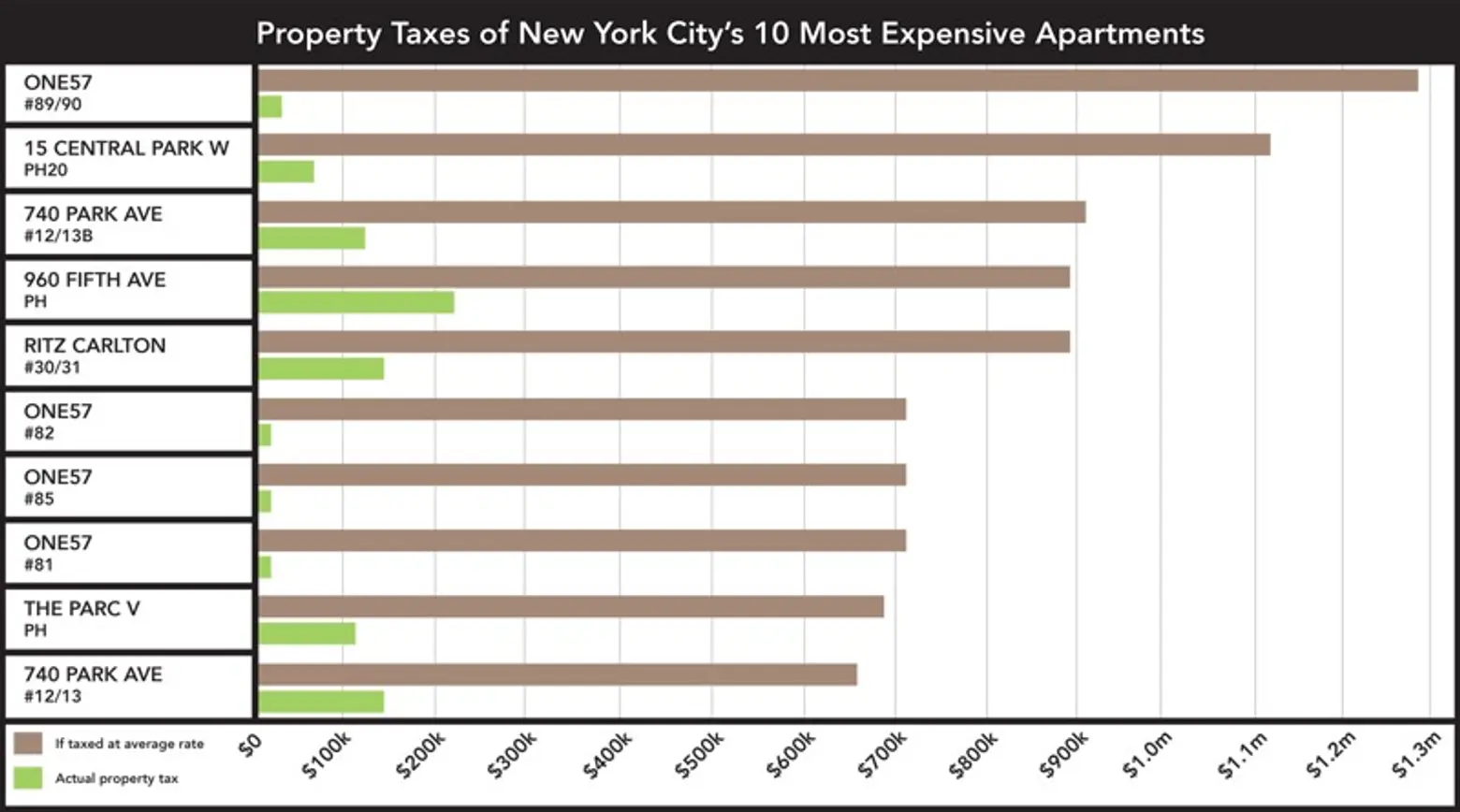

Charting the Property Taxes of the City’s 10 Most Expensive Apartments

Back in March, we learned that the owner of the $100 million apartment at One57 (the most expensive sale ever in the city) pays only $17,268 in annual property taxes– “or 0.017 percent of its sale price, as if it were worth only $6.5 million,” as we noted. “In contrast, the owner of a $1.02 million condo nearby at 224 East 52nd Street is paying $24,279, or 2.38 percent of its sale price.” Why does this happen? It’s in part due to the 421-a program, which offers tax breaks for the inclusion of affordable housing and “lowers the billable-assessed value of a property to incentivize real-estate development,” according to CityLab. It’s also thanks to the city’s haphazard system for assessing market values of condos and co-ops.

In response to this growing issue of inequality, Mayor de Blasio announced just last week that he hopes to end 421-a for condos, as well as implement an even stricter mansion tax. To make the issue a bit more black-and-white, CityLab has put together two charts that show just how disproportionate the actual value of the city’s ten most-expensive apartments is compared with their property taxes. As they note, “In NYC, billionaires pay 1/100th the average property-tax rate.”

The charts, put together using data from Max Galka, co-founder of real estate data site Revaluate, looked at the ten biggest condo sales to date in New York, excluding the $91.5 million sale at One57 that closed last month. We can see that the property taxes at One57 are the lowest, and this is thanks to its location on billionaires row. Galka’s report states: “Properties in fast-appreciating neighborhoods end up with lower effective tax rates than identically-valued properties in neighborhoods with more stable prices.”

In addition to reforming the 421-a system, the Mayor wants to up the mansion tax. “Currently, home sales over $1 million are subject to a 1 percent tax, but de Blasio proposes adding an additional 1 percent tax for sales over $1.75 million, as well as a third 1.5 percent tax for sales over $5 million,” we reported. The current state property assessment laws were implemented in 1981, a time when the city was in dire need of development, but now the pendulum has moved in the other direction. A study from the Municipal Arts Society that looked at which luxury skyscrapers are siphoning our tax dollars showed that, in 2014, the city forfeited $1.1 billion in tax revenue, 60 percent of which went to building Manhattan apartments aimed at the 1 percent.

[Via CityLab]

Charts via Mark Byrnes/CityLab; Data via Max Galka

RELATED:

- To Increase Affordability, Mayor de Blasio Wants to End 421-a for Condos and Up the Mansion Tax

- Owner of $100M Apartment at One57 Only Pays $17,268 in Property Taxes

- New Map Reveals Which Luxury Skyscrapers Are Siphoning Your Tax Dollars

- Five Luxury Towers Will Account for One-Third of New Development Sales over the Next Five Years