NYC Trying to Preserve Low Rents in Stuy Town, Asks CWCapital Asset Management to Hold Off on Sale

Photo via Wiki Commons

Photo via Wiki Commons

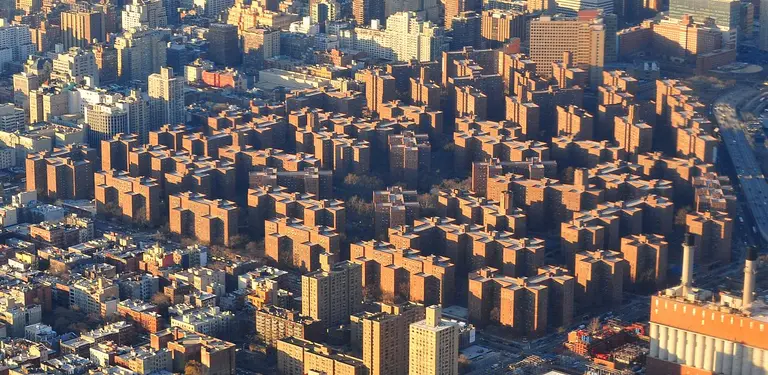

Here we go again. Stuyvesant Town and Peter Cooper Village on Manhattan’s east side have a long history of being an affordable option for middle-income workers. But these days its hold on that place in the city’s housing landscape appears tenuous at best.

Though rent-stabilizations laws have been in effect for many units and about half are below-market rates, the remainder is comprised of luxury apartments, with one-bedroom units fetching as much as $2,900 a month, more than double the rate in 2006 when nearly ¾ of the units were below market. And with the property poised to sell for billions of dollars, the trend towards more luxury rentals seems likely.

Now the city is doing its best to secure a plan that will preserve low rents on about half of the 11,200 units as CWCapital Asset Management, which represents the senior creditors in control of the property, has agreed to hold off on any sale for the next 60 days. In that time the city is hoping to put together a package of tax breaks or other incentives to structure the bidding process in favor of buyers who would keep rents on some of the units low.

While open to supporting “some of the City’s policy objectives”, according to their managing director, Andrew MacArthur, CWCapital is well aware of its duty to investors and any plan must successfully balance both objectives.

Housing experts are skeptical citing that many of the current tenants are already exceeding the income threshold necessary to qualify for affordable-housing subsidies. With CWCapital moving towards a sale this year or next, the city now has two months to make their goal of preserving a piece of the complex’s affordable housing history come to fruition.

[via The Wall Street Journal]