Jared Kushner will leave role as CEO of Kushner Companies

In just 11 more days, Donald Trump will take office as the 45th President of the United States. And just as Trump is gearing up for his four-year term, his son-in-law Jared Kushner and daughter Ivanka Trump are preparing to take on major roles as well. Last week it was revealed that the pair would be moving into a six-bedroom, $5.5 million mansion in D.C., and now the New York Times reports that Kushner will step down as CEO of Kushner Companies as he transitions from real estate mogul to full-time presidential advisor.

The real estate wunderkind played a critical role in getting Trump elected, and like Ivanka, Kushner continues to be firmly established in Trump’s small pool of trusted advisors. As such, Kushner been taking all the necessary steps to make his own passage into the White House seamless—and this means backing away from his family’s business.

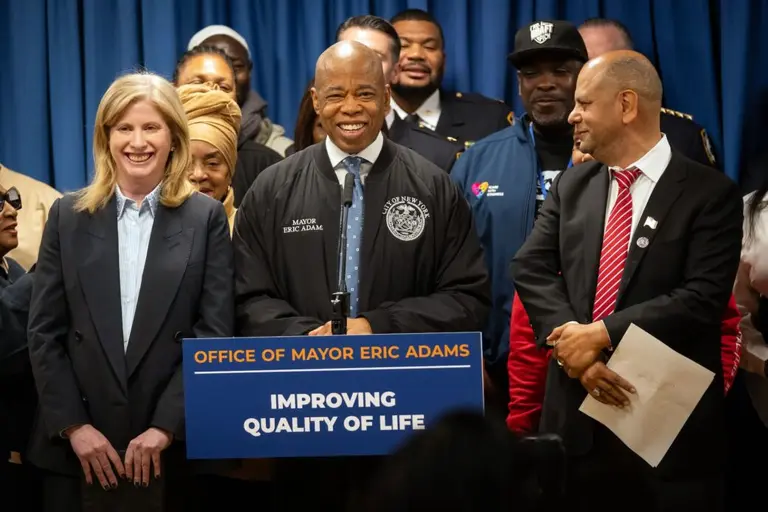

“Mr. Kushner is committed to complying with federal ethics laws, and we have been consulting with the Office of Government Ethics regarding the steps he would take,” said Jamie Gorelick, a partner at law firm WilmerHale, who is representing Kushner and who served in the Clinton administration, to the Times. Moreover, Kushner will also divest a share of “substantial assets,” including 666 Fifth Avenue, which he purchased for a record $1.8 billion in 2007; The buy is widely recognized as what put both a young Jared and his company on the Manhattan map.

All in all, Kushner Companies claims a portfolio of 20,000 multi-family, residential buildings, plus 12 million square feet of office, industrial and retail space in New York and New Jersey. The paper outlines a number of conflicts of interest that could rise from these holdings, particularly when it comes to the company’s foreign ties.

Kushner Companies is both active and booming, and over the past 10 years has been involved in roughly $7 billion worth of transactions. The sticking point, says the Times, is that most have been “backed by opaque foreign money” as well as the financial institutions Trump will soon be regulating with the help of Kushner, who is expected to be involved in a number of foreign policy matters. One example: As an Orthodox Jew, Trump wants Kushner to be a key player in smoothing things over in Israel; he could help bring “peace in the Middle East,” Trump has said. Kushner Companies, however, has been the recipient of a number of loans from Bank Hapoalim, Israel’s largest bank.

More recently in NYC, the paper writes of dealings with Wu Xiaohui, the chairman of Anbang Insurance Group, which acquired the Waldorf Astoria for nearly $2 billion in 2004. Wu and Kushner were said to have been hashing out how they could work on redeveloping 666 Fifth Avenue via joint-venture, and during the meeting Wu also expressed his desire to meet Donald Trump. The Times highlights that Anbang’s recent aggressive efforts to buy up hotels in the U.S. were curtailed by Obama administration after officials who review foreign investments for national security risk raised concern.

Ethics experts who spoke with the Times seemed to all agree that ethical questions will arise. And while Kushner will be required to make some financial disclosures to the public regarding his holdings and step back from making any decisions that could have “direct and predictable effect” on his financial interests, things will be murky at best.

Matthew Sanderson, former general counsel to Senator Rand Paul’s presidential campaign, told the paper that negotiations with firms like Anbang “might not be illegal under the conflict-of-interest rules, but [they do] raise a strong appearance that a foreign entity is using Mr. Kushner’s business to try to influence U.S. policy.” He added that Kunsher relinquishing his title and selling off select assets is just a “half-measure” that “still poses a real conflict-of-interest issue and would be a drag on Mr. Trump’s presidency and cause the American people to question Mr. Kushner’s role in policy making.”

[Via NYT]

RELATED: