Learning from Seattle: How Amazon could shape NYC real estate

Via CityRealty

Since Amazon announced it had selected Long Island City for its new headquarters last fall, a lot of people have wondered what will happen to the neighborhood and its surrounding communities. While LIC has already undergone a series of radical changes of the past two decades—first there was an influx of artists seeking larger live-work spaces and later a wave of condo developments—the arrival of Amazon promises to have an even deeper impact on LIC.

And the potential negative effect of the tech giant moving into town has not gone unnoticed by public officials and locals, who have led a strong opposition campaign. It was reported on Friday that Amazon was reconsidering its plan to move to the neighborhood after facing an intense backlash from those who fear increased rents and even more congestion. But with no plan to officially abandon Queens, it’s important to understand what could happen if Amazon does put down roots in LIC by first looking at how the company has already changed Seattle, where it first set up shop back in 1994.

Via Wikimedia

The Amazon Effect

Jeff Bezos reportedly originally wanted to establish Amazon’s headquarters on a Native reservation near San Francisco where he hoped to make the most of state taxation loopholes. In the end, he settled for Seattle instead and more specifically, for Seattle’s Beacon Hill neighborhood. When Amazon outgrew its Beacon Hill headquarters, it moved to a less developed part of Seattle’s South End. Over the past decade, the company has transformed South End on every level. After all, along with Amazon and its thousands of employees, a host of other businesses and services have moved into the neighborhood to serve Amazon employees.

On the job front, Amazon has been good for Seattle. In 2010, the company employed 5,000 residents. By 2017, it employed over 40,000 residents. By the beginning of the next decade, Amazon predicts that it will have over 55,000 employees based in the city. Given that Seattle is only home to 725,000 residents, the number of jobs is particularly staggering. In addition, thanks to Amazon and the many other tech companies have located to Seattle—largely to benefit from the city’s growing wealth of tech talent—Seattle is now the fastest-growing U.S. city. But Seattle’s rapid growth and job creation have also come at a cost.

Tech Hubs and Housing

While Amazon has helped Seattle generate jobs, including many high-paying jobs, its impact on housing hasn’t been as positive. A 2017 article published by Politico found that due to the influx of highly compensated tech workers, the median house price in Seattle has soared 69 percent since 2012. While even many tech workers, who make on average $98,215 annually, now struggle to find adequate housing, the situation is much worse for people not working in the tech industry.

On average, non-tech workers in Seattle earn about half of what the average tech worker earns—less than $50,000 on average. But to be fair, this isn’t just an Amazon or Seattle problem. In fact, many analysts and housing activists now believe the real problem is the broader tech industry.

In San Francisco and the surrounding Silicon Valley, the housing situation has gotten so bad, it is now regularly being described as an emergency. While this may sound extreme, it’s not. Many workers, especially workers who serve people in the tech industry (e.g., cooks, cleaners and other people in service industry jobs) have resorted to living in RVs and converted garages in a housing economy with few options at all for low-income and even middle-class families.

While the Bay Area crisis has been on the radar for years, it also appears to keep getting worse. In the first half of 2018, the average price of a house bought in San Francisco rose by $205,000. It represented the largest six-month increase in history, bringing the average cost of an area home to $1.62 million.

Via Wikimedia

Woodside & Sunnyside Owners to Likely Benefit

Whatever happens, one thing is clear: Amazon’s LIC arrival will increase the value of properties in Woodside and Sunnyside and may even result in a surge in values in other parts of Queens over the coming decade. In fact, within days of the Amazon announcement, local housing was already being impacted. One LIC development, Corte, reportedly raised prices on its units by $30,000 immediately following Amazon’s announcement in November.

At the same time, with the announcement, the future of a planned housing development that promised to create 1,500 affordable units were thrown into question. This begs the question—who will the biggest winners and losers be as Amazon pushes into LIC?

According to the NYU Furman Center, Woodside/Sunnyside, which includes LIC, is currently home to 135,767 residents. Median household incomes in 2016 were $63,494, and the poverty rate in Woodside/Sunnyside was 10.1 percent (approximately half the citywide average). While not necessarily an expensive neighborhood compared to many neighborhoods in Manhattan and Brooklyn, in 2016, Woodside/Sunnyside rental prices were already well above average for Queens.

In fact, according to the Furman Center, “26.7 percent of renter households in Woodside/Sunnyside were severely rent burdened (spent more than 50 percent of household income on rent).”

With the arrival of Amazon, there are concerns that the gap between local incomes and rental prices will grow, leaving many current residents struggling to hang on to their homes.

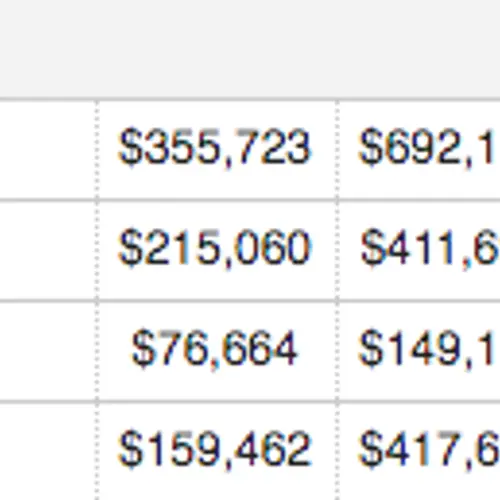

Furman Center data for Woodside/Sunnyside also reveals another notable trend in recent years—the rapidly rising cost of purchasing properties in the area and specifically, condos. In 2000, the average price of a Woodside/Sunnyside condo was just $159,462 (adjusted for inflation). Less than two decades later the average condo was selling for more than five times that amount. But with Amazon’s arrival, there are worries these prices may soar even higher.

Via NYCEDC

Let’s say the Amazon effect in LIC is equal to the Amazon effect in Seattle where housing prices soared 69 percent between 2012 and 2017. In LIC, this would push medium prices of condos and homes well above the $1 million dollar threshold by the mid-2020s.

Again, while this will certainly be great news for anyone who bought into the neighborhood early on, especially before 2010, it is bad news for new arrivals who may struggle to buy LIC, even with a tech salary.

RELATED: