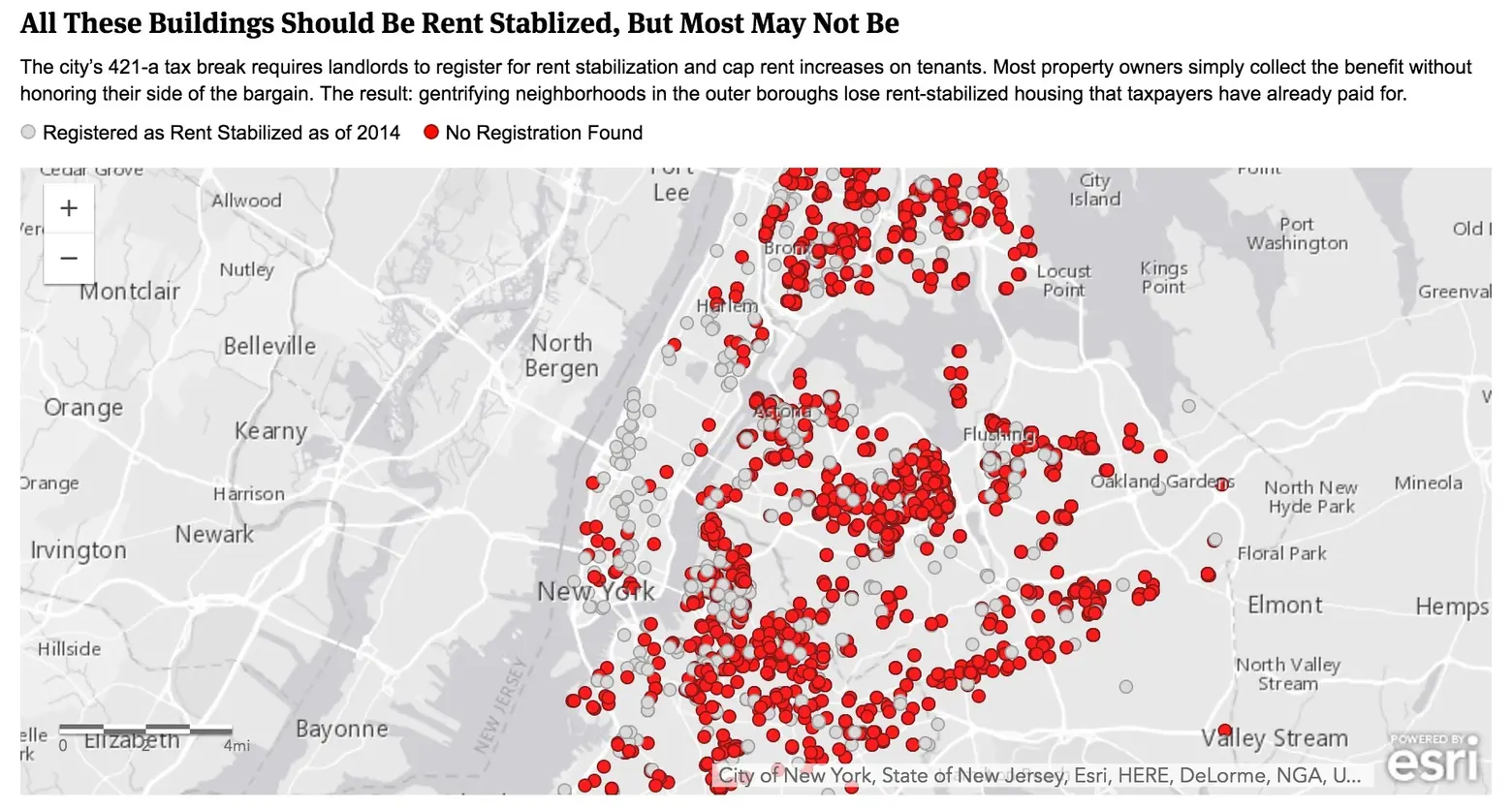

MAP: Two thirds of landlords benefiting from 421-a tax breaks didn’t file rent regulation paperwork

View the map from ProPublica in its interactive form here >>

The city’s 421-a program, which expired in January, provides tax breaks of up to 25 years to new residential buildings that reserve at least 20 percent of units as affordable. Proponents of the program feel it offers a much-needed incentive to build low- and moderate-income housing, but those not in favor think it gives unfair tax breaks to the wealthiest developers. The latter camp may be gaining steam, as a new report from ProPublica, outlined in Gothamist, says that nearly two thirds of the 6,400 rental buildings where landlords received tax reductions through 421-a didn’t have required rent stabilization paperwork on file, meaning they could raise rents as much as they chose. ProPublica compiled this data in both an interactive map and searchable database.

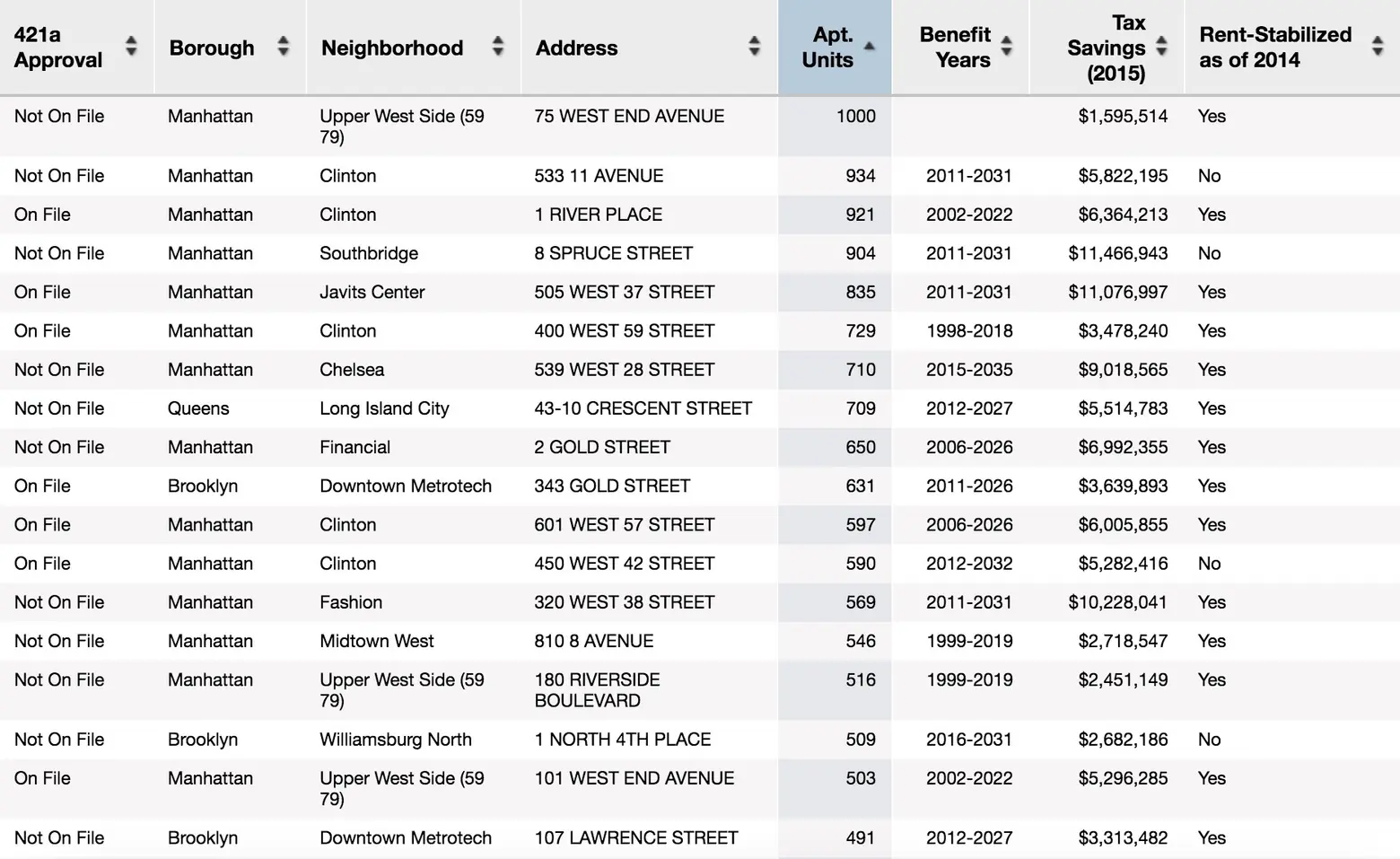

A sampling of the searchable database

ProPublica estimates that these landlords have collectively saved $300 million annually in property taxes, some of whom have been reaping the benefits for more than 20 years while awaiting official approval from the Department of Housing, Preservation and Development and the Department of Finance. The city agencies, who have historically blamed each other for the issue, both play a part. Last year, HPD charged developers $27 million in fees to process 421-a applications, but only paid out $560,000 to nine employees to do so. These applications often sit in limbo for years (there are more than 2,200 from 2000 through 2010 still pending), but the Department of Finance will still sign off on them, meaning landlords receive the tax benefits without actually registering as rent stabilized and thereby being required to adhere to the city’s rent increase caps.

Both HPD and the Department of Finance say they’re working to identify property owners skirting the law and sending them notifications to comply or lose their benefits. And de Blasio has put forth reforms that would “require owners to meet all 421-a eligibility criteria before benefits are issued and set aside more units for low-income renters.” This has yet to win approval from the state, where the Governor has been working to revive 421-a with wage subsidies.

To see if your landlord is illegally receiving 421-a tax breaks, search the database here >>

[Gothamist via ProPublica]

RELATED: