New report finds neighborhoods in the Bronx lead the city in missed mortgage payments

Photo by Nelson Mejia Jr. on Flickr

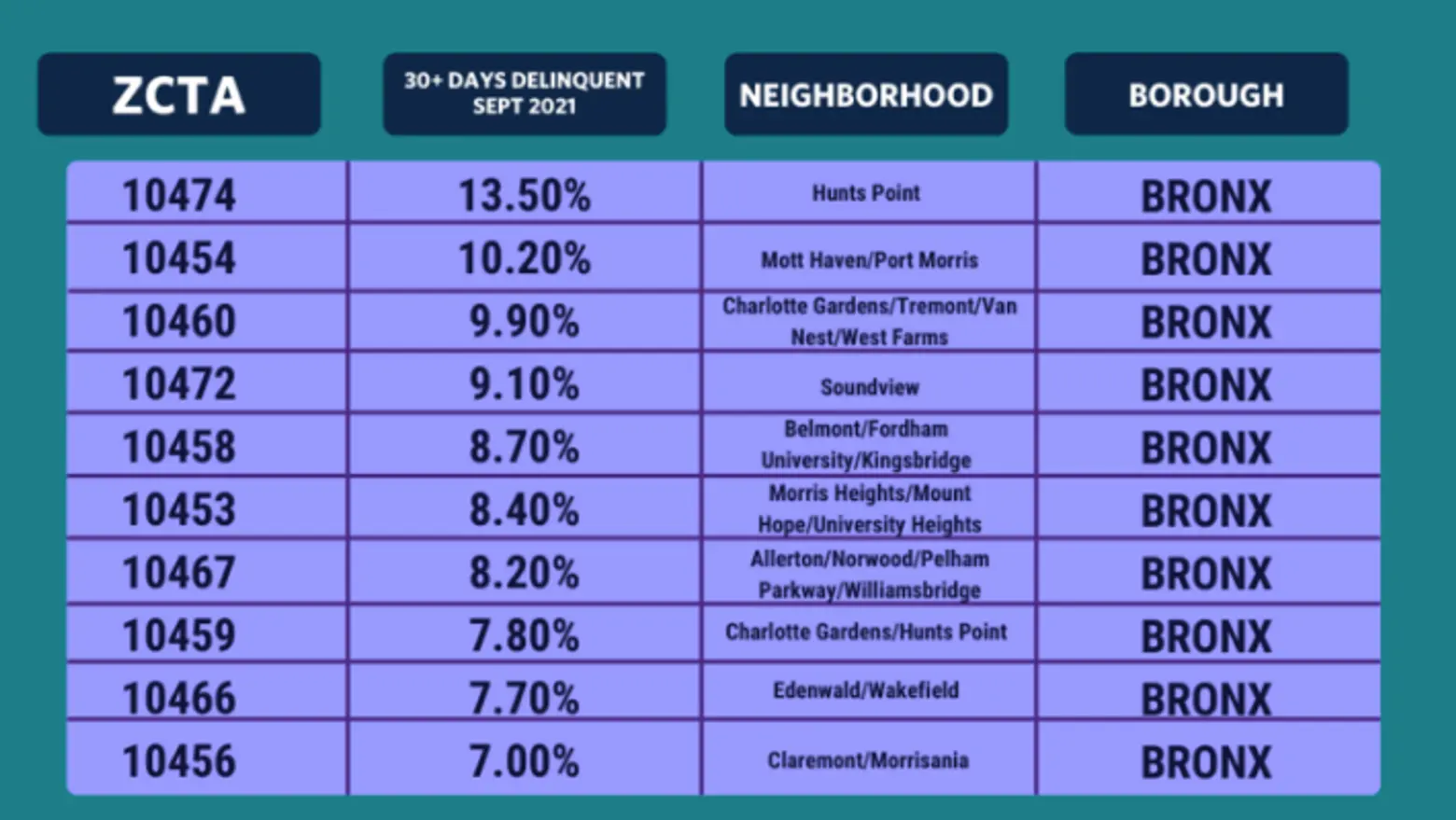

Two years after the start of the coronavirus pandemic, Bronx neighborhoods are leading the city in mortgage delinquency rates, according to a new analysis by the Center for NYC Neighborhoods. Plus, the city’s majority Black neighborhoods were most at risk for foreclosures, with these ZIP codes having an average of 8.48 percent of homeowners who had failed to make their mortgage payment for more than 30 days, as first reported by The City.

Image courtesy of the Center for New York City Neighborhoods

Image courtesy of the Center for New York City Neighborhoods

According to the nonprofit organization, which promotes affordable housing in New York, 17 out of 25 ZIP codes in the Bronx, or about 70 percent, had delinquencies above 4.17 percent, with Mott Haven and Hunts Point having a rate of 13.5 percent. The city average is roughly 4 percent.

In Brooklyn, 20 out of its 37 zip codes showed above-average mortgage delinquency, with eight zip codes having a rate above 10 percent. Nearly half of Queens ZIP codes had an above-average rate, with the Queens Village, Jamaica, and Edgemere neighborhoods possessing leading rates above 9 percent.

According to the report, coastal areas more prone to flooding, like Far Rockaway in Queens and the Bergen Beach and Canarsie neighborhoods of Brooklyn, showed disproportionately high rates of mortgage distress. These same neighborhoods see more of an impact by the city’s annual tax lien sale as well.

The group found these rates followed historical patterns; some of the neighborhoods heavily impacted by the 2008 financial crisis bore the highest rates. According to The City, these neighborhoods were also targeted by subprime loan lenders leading up to the financial crisis.

Many of these areas were protected from foreclosures until the state’s eviction moratorium expired in January.

As The City reported, racial disparities among mortgage delinquency are seen throughout the state, with 3.4 percent of white homeowners stating they were likely to be forced to leave their home in the next two months, compared to 9.4 percent of Black homeowners who expressed the same sentiments, according to a recent U.S. Census Household Pulse Survey.

Similarly, 4.4 percent of white homeowners said they were not confident they would be able to pay the next month’s mortgage payment, while 17.4 percent of Black homeowners echoed the same concerns.

The CNYCN recommends certain policy changes to help homeowners in need, including funding and supporting foreclosure prevention services in the city, permanently canceling the city’s tax lien sale, funding homeowner-landlord services to better relations between tenants and landlords, legalizing safe basement apartments, and helping to lower aggressive speculation and scams in low-density neighborhoods.

As part of Hochul’s proposed executive budget released earlier this month, the state would allocate more than $400 million towards homeownership initiatives. In December 2021, Hochul announced that the state would be receiving $539 million through the Homeowner Assistance Fund to help low and moderate-income homeowners avoid mortgage delinquency, foreclosures, and displacement. While the fund is no longer accepting applications, applicants are still able to register for the waitlist, which can be found here.

RELATED:

- New York’s eviction moratorium will end this week, Hochul confirms

- Hochul announces $539M fund to help New York homeowners who are behind on payments

- NYC is offering low-income, first-time homebuyers $100K toward down payments

- Everything you need to know about affordable housing: applying, getting in, and staying put