New Yorkers are bypassing food trucks for McDonalds as fast food finds new footing

Image: Wikimedia commons

Even as New York City continues to experience record financial growth, a small explosion of fast food chains within city limits still comes as somewhat of a surprise. A recent Crain’s article confirms that, even more surprisingly, McDonalds, perhaps the fast-foodiest of all, is not only expanding but polishing up its image to appeal to a more upscale market–and it’s working. You might just chalk it up to a sweeping takeover by big chain stores, but isn’t that about gentrification? Fast food has traditionally had a big presence in the city’s lower-income neighborhoods–known as “food swamps“–and in tourist areas. But the nation’s largest Chick-fil-A just opened in…the Financial District. Reasons for the latest fast food boom are many, it turns out, and extend beyond mere mallification.

Crains reports that a substantial minimum wage hike for fast food workers that began in 2015 with a mandate from a state-appointed board hasn’t affected the industry in the way many predicted it would. Instead of being driven away by prohibitive labor costs, fast food restaurants have expanded substantially. This phenomenon may be due at least in part to a strategy adopted by franchisers like Paul Hendel, who runs 25 McDonald’s in the NYC area. Instead of cutting jobs because of higher labor costs, Hendel has been investing more to polish up the golden arches to appeal to 21st century diners. Hendel has modernized his Mickey Ds with ordering kiosks, table delivery and renovated dining rooms with comfy furniture rather than the usual cramped plastic tables. Though new self-serve kiosks eventually could mean fewer employees, Hendel says he’s actually employing more people to serve customers.

The overhaul is part of a $320 million corporate plan to renovate 360 New York McDonald’s restaurants in an attempt to entice customers who eschew Big Macs while retaining loyal ones. According to Hendel, it’s working. “Most of my modernized stores are seeing double-digit sales bumps.”

And it’s not just McDonalds, though that chain’s turnaround is notable because it was one of the only fast food brands in decline in recent years. Chick-fil-A, Taco Bell, Popeye’s, Five Guys and Arby’s are on the upswing in the city, where they’re increasingly becoming contenders for a growing number of workers (a record 4.4 million New Yorkers are employed) seeking fast, cheap lunch options. An influx of residents from the suburbs are also finding a familiar face in the chain restaurants’ branding. And tourism has doubled to over 60 million in the past two decades; tourists on a tight budget or looking for something familiar are skipping the city’s bounty of authentic ethnic offerings for the nearest McDonalds.

There is a mallification element to the expansion, of course: Chains of all kinds are replacing diners and other small local eateries forced out by skyrocketing rents; the number of restaurants in the city has actually dropped. Another void filled by fast food: According to Crain’s, the city’s chain steakhouses that typically serve a dying breed of expense account clients are struggling. According to David Henkes, senior principal at consulting firm Technomic, “Momentum is really on the side of quick-service restaurants.”

But despite the temptation to fill a void, a move to the big city represents a change in thinking for the fast food outlets, who generally avoided the city because of high overhead and, to be frank, less love. But Manhattan diners seem to be rediscovering big-brand fast food. Despite prohibitive costs and choosy customers, NYC may be the one place in the country where there’s still any upside, a fact which is rapidly being remedied. Though there is reportedly a glut of fast-food restaurants across the country as a whole New York is still relatively underrepresented.

And foot traffic is unrivaled. The Chick-fil-A at the corner of West 37th Street and Sixth Avenue in Manhattan’s Garment District sells more than 3,000 sandwiches a day (that’s one every six seconds), adding up to about $13 million in revenue, the chain has plans to open 12 more restaurants in the city, including that new 12,000-square-foot Financial District emporium.

Image: Taco Bell

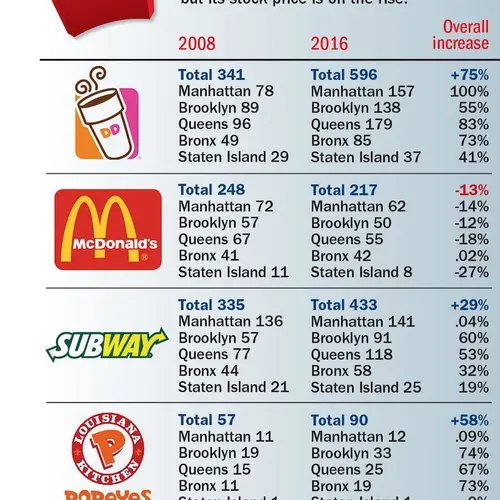

According to the Center for an Urban Future, the food sector was responsible for almost all of the growth in local chain retailers and restaurants between 2008 and 2017. Dunkin’ Donuts, with the highest number of New York City stores at 596, has seen a 75 percent increase since 2008. Taco Bell has announced plans to triple its current city presence. And, like the others, the chain is changing its image, with their biggest news being the addition of booze to its newly-launched “Cantina” concept locations. Taco Bell Cantinas–which started in Chicago–bypass fast food tropes like drive-thrus for urban-friendly design, an open kitchen, and tapas-style menus. The chain plans to open three Cantinas in Manhattan, with two locations in Midtown and one in Chelsea.

As with McDonalds rebranding, savvy choices by fast food restaurants have kept their relevance on the rise: The chains have been hopping onboard with home-delivery outfits like UberEats and Seamless. Hipper offerings like Chipotle and niche spots like Danny Meyer’s Shake Shack have also opened the door to a new acceptance of fast food.

Image: McDonalds

The health angle has been perhaps the hardest to navigate, but the imperative to list calorie counts may be less of a blow to the industry than expected. Calorie postings may not always put burgers and fries in the best light, but at least you know what you’re eating. Lower calorie options on virtually all fast food menus have begun to seem favorable to a food-truck treat bursting with calorie-and-carb-laden goodness. And it’s worth noting that, according to data from Center for an Urban Future’s 2017 “State of the Chains” report, Subway, whose branding strategy has been to provide a healthier alternative to other fast food choices, leads the way among the fast food brands in number of New York City locations.

The minimum wage rise isn’t the only labor phenomenon to be brewing in the fast food industry. Though fast-food workers are still legally unable to unionize, a New York City law went into effect in 2017 that allows them to organize. And organizing they are: A new group called Fast Food Justice is calling for decent wages and employee rights. With so many factors that point to a prohibitive environment, America’s classic fast food chains appear to be gearing up for a new kind of second act, albeit with less competition from local businesses, but with less-expendible employees and big-city appeal.

RELATED: