NYC unveils rules for 485-x tax break, office-to-residential incentive

Credit: Bex Walton on Flickr

The city’s Department of Housing Preservation and Development (HPD) on Monday released proposed rules for 485-x, the tax exemption that replaced 421-a, and the new 467-m incentive for converting offices into housing. The proposals must be finalized before HPD can approve applications for both programs, The Real Deal reported.

Approved by state lawmakers in April, the 485-x tax break is a 10-year program that succeeds 421-a, which expired in 2022 and gave developers a tax exemption in exchange for including some affordable housing units in residential buildings. The new program provides a 40-year exemption, up from 35 years.

Developers have been able to register online to receive the benefits since June when the online portals for the incentives went live.

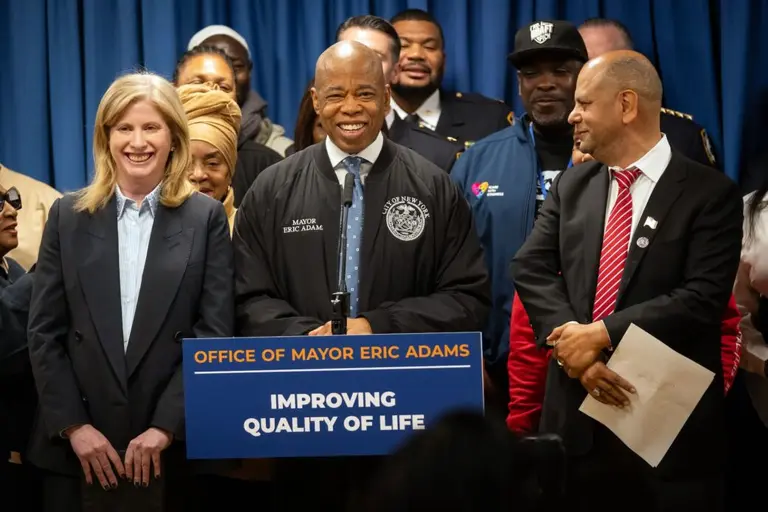

“We are working quickly to roll out the new programs created by the state in partnership with HPD and the administration because we don’t have time to waste. People need homes now,” HPD Commissioner Adolfo Carrión said in an official statement.

To qualify for 485-x, rental projects with 150 or more units in certain locations, including Manhattan south of 96th Street, western Queens, and parts of Brooklyn, must have at least 25 percent of homes income restricted at an average of 60 percent of the area median income.

Rental projects across the city with 100 or more units will require at least 25 percent of homes to be income restricted at an average of 80 percent of the AMI, while projects citywide ranging from six to 99 units will require at least 20 percent of homes to be income restricted at 80 percent of the AMI.

Projects with six to 10 units outside of Manhattan can opt for a smaller benefit and permanently restrict at least 50 percent of units as rent-stabilized units.

Through 485-x, construction workers on projects of 100 units or more will be guaranteed a minimum wage of $40 per hour. Workers on projects with 150 or more units located in areas of Manhattan below 96th Street, western Queens, and parts of Brooklyn will receive between 60 and 65 percent of the “greatest prevailing wage rate,” or between $63 and $72.45 per hour.

The key requirements for 467-m include the conversion of a non-residential property into a rental multiple dwelling with six or more apartment units, applying within one year of construction completion, starting construction between January 1, 2023 and December 31, 2031, and completing construction on or before December 31, 2039.

The proposed rules for the tax break also clarify what qualifies as a “reasonable effort” by developers to spend at least 25 percent of contract costs on minority- and women-owned businesses (MWBE) throughout the design and construction of projects, which is required to obtain the tax break, according to The Real Deal.

However, YuhTyng Patka, a partner and real estate attorney at Adler & Stachenfeld, said it is still “murky” how projects that began after 421-a expired but before 485-x was approved would be able to provide a “reasonable effort.” During that 22-month period, developers were unaware that the new program would have MWBE hiring requirements.

“There doesn’t seem to be a surefire way of complying, and I think that is somewhat problematic,” Jason Hershkowitz, a partner and real estate attorney at Seiden & Schien, told The Real Deal.

Hershkowitz claims that the proposed rules give HPD a lot of discretion in deciding whether or not developers made a reasonable effort to meet the 25 percent requirement.

The city’s proposed rules for 485-x and 467-m decrease the rents for affordable units, which are distributed through the city-run NYC Housing Connect website. Initially, apartments will be marketed at affordable rates to households earning three percentage points below the AMI detailed in the legislation—77 percent of the AMI instead of 80 percent.

The three percentage point reduction is common in other HPD programs and is designed to increase the number of low-income families that qualify for the apartments. According to The Real Deal, HPD does not believe the change will disrupt the financing of 485x projects, but it might still affect underwriting.

Developers are still awaiting information on the penalties for failing to comply with 485x’s affordability and wage requirements. While penalties for wage requirements will be determined by the city comptroller, HPD’s initial set of rules does not specify fines.

State legislation indicates that penalties will be calculated as a percentage of the program benefits, but cannot exceed 1,000 percent. HPD is expected to release a penalty schedule separately, according to The Real Deal.

The final rules will take effect 30 days after publication, with HPD expecting to implement them in January 2025.

RELATED:

Interested in similar content?

Leave a reply

Your email address will not be published.

lets see how many TRULY AFFORDABLE HOUSING will get built, lets see where will they build these units, will they the keep the segregated communities segregated when it comes to these AMI bands, building more unaffordable and a very small amount of true affordable units in the black and brown communities, and building higher up middle/market rate units in the better off white neighborhoods, is this another give away to the greedy profit over people developers, lets see how long will it take, while more people become homeless, pushed out of NYC.