The richest New Yorkers would benefit the most under Trump’s tax plan

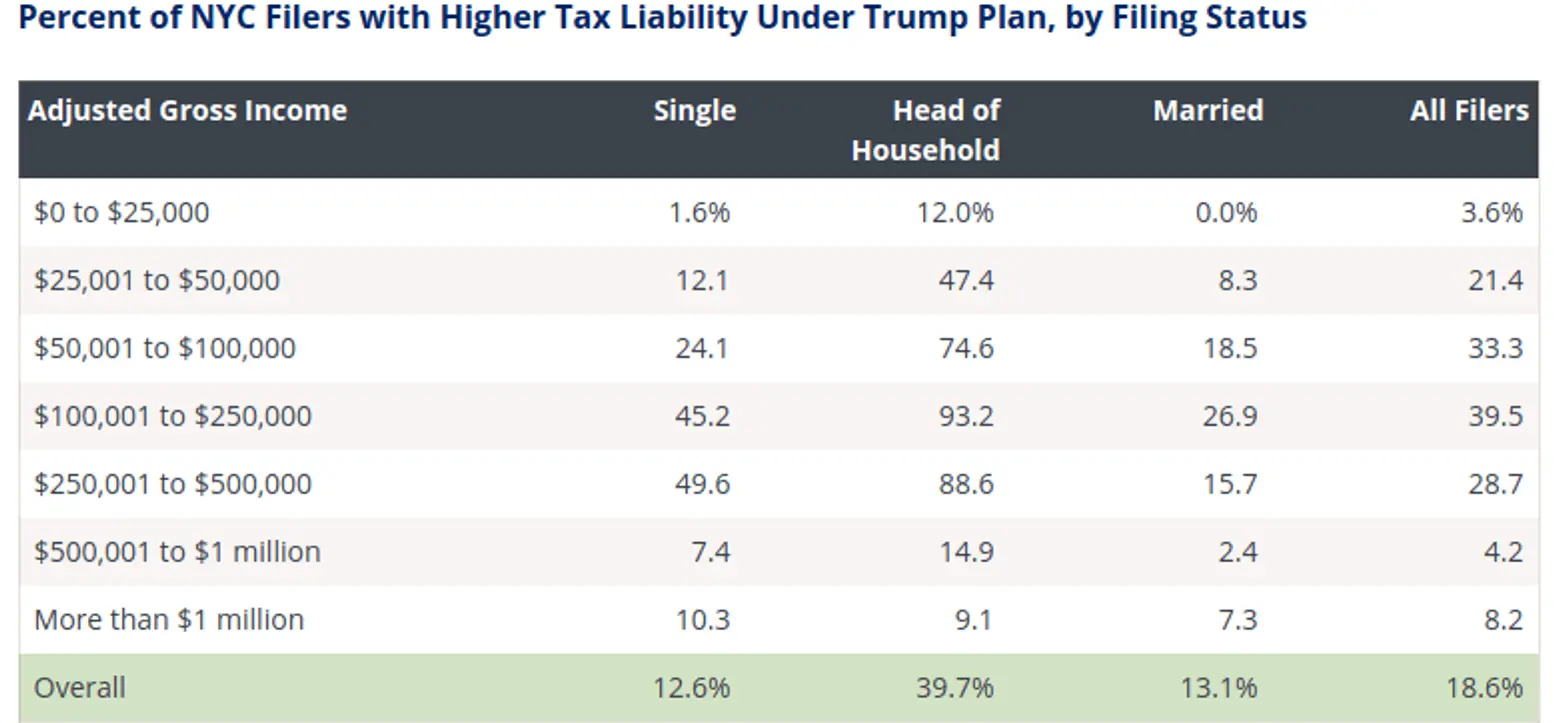

New York’s top elected officials, aware of the political leanings of their constituents, continue to be outspoken in their opposition to President Trump and his administration. As Crain’s reports, City Comptroller Scott Stringer serves as one of New York’s most vocal assailants on Trump, with 50 percent of his press releases written this month attacking the president’s policy proposals. In a report released this week, Stringer analyzed Trump’s proposed federal income tax law and found that it disproportionately benefits the highest-income earners in New York. If adopted, 40 percent of all single parents would see their taxes go up, compared to 90 percent of millionaires who would see a reduction, according to Stringer.

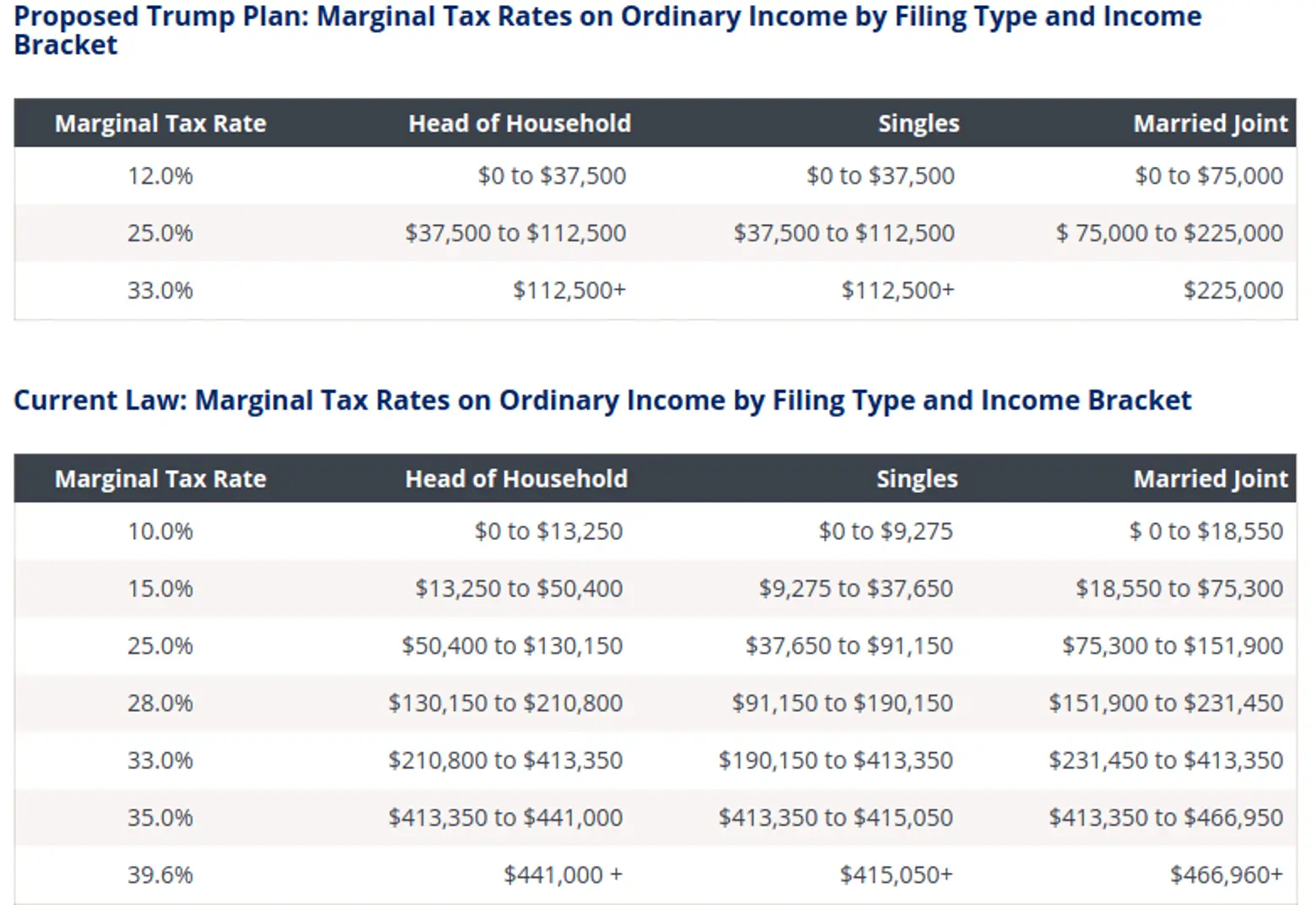

The comptroller’s analysis of the plan found that more than one-third of moderate and middle-income families in New York City would see an increase in taxes, as opposed to the highest earners who would get significant tax reductions. Since the plan calls for the elimination of the Head of Household filing, the analysis said this could make single parents face higher marginal taxes. Under the Trump tax plan, a Head of Household filer would be subjected to an income tax rate of 25 percent on income greater than $37,500, compared to only 15 percent under the current law.

To determine the impact the proposed tax plan would have specifically on New York City households, Stringer’s office used data from more than 365,000 income tax records. They examined the effects by looking at six different income brackets and for three filing types in order. The results of this research found that the wealthiest New Yorkers gain from Trump’s tax proposal. Nearly 96 percent of filers with income between $500,000 and $1 million and 92 percent with income above $1 million would pay less in taxes. Moderate and middle-income New York taxpayers may get hit the hardest under Trump’s plan with its higher marginal tax rates and elimination of personal exemptions.

It’s not all bad news, however. The most low-income New Yorkers would receive some benefits, or at least have their situation stay the same. Under the Trump plan, married couples with incomes below $30,000 and singles with income less than $15,000 face no tax liability. Additionally, these filers may benefit marginally from the enhanced Earned Income Tax Credit (EITC) for childcare expenses. The next paragraph in Stringer’s report invalidates this by listing the proposed cuts to federal aid programs, almost $400 million to city programs, that would adversely affect low-income New Yorkers. Trump’s proposed budget majorly reduces funding for affordable housing programs, which could greatly affect the city’s low-income seniors, as 6sqft recently covered.

[Via Crain’s]

RELATED:

- Comptroller Scott Stringer lays out plan for NYC to invest in its seniors

- NYC schools, housing, and transit to lose hundreds of millions in federal aid under Trump’s budget

- NYC’s drinking water may be at risk after Trump’s environmental cuts

All charts courtesy of City Comptroller Scott Stringer’s office

Get Insider Updates with Our Newsletter!

Leave a reply

Your email address will not be published.

Trump doesn’t know what it is to be poor as a child so he cannot remember or relate to it.he cannot share empathy because he was never poor,never raised in a tenament never had to do without food because daddy or momma lost her job or was laid off.Came from a big family or had to work two jobs to make ends meet.